Key takeaways

- Capital rotation is happening inside the crypto ecosystem rather than flowing in from outside.

- Price action is likely to stay choppy and range-bound, with occasional sharp moves driven by thin order books rather than strong conviction.

- Bitcoin has been in repair mode. December has mostly been about finding footing rather than pushing for upside.

- The ETH/BTC ratio is still sitting near multi-year lows, which reinforces the same message the tape has been sending for months: institutional preference remains firmly tilted toward Bitcoin.

Market overview

The market is settling into a familiar late-December pattern after a noisy fourth quarter. The Fed’s 25bp rate cut on December 10, which moved the target range to 3.50%–3.75%, delivered a short-lived liquidity tailwind.

That effect has largely burned off. With Christmas approaching, participation has dropped, and most traders are either trimming exposure or simply stepping aside.

On the macro side, the picture is mixed. US labor data continues to soften, but inflation remains stubbornly around the 2.9% area. That combination has pushed the Fed into a wait-and-see posture heading into 2026. Expectations for rapid follow-up cuts in Q1 have cooled, and the market has adjusted accordingly.

Risk appetite reflects that shift. Sentiment sits between neutral and mildly defensive. Capital rotation is happening inside the crypto ecosystem rather than flowing in from outside. Alts continue to bleed into Bitcoin, and from there into stablecoins, a typical end-of-year safety trade when conviction is low.

From a market structure perspective, this points to consolidation. Price action is likely to stay choppy and range-bound, with occasional sharp moves driven by thin order books rather than strong conviction. Volatility spikes are possible, but follow-through should be limited. Meaningful trend development is more likely once institutional desks are fully back online in January.

Bitcoin (BTC) analysis

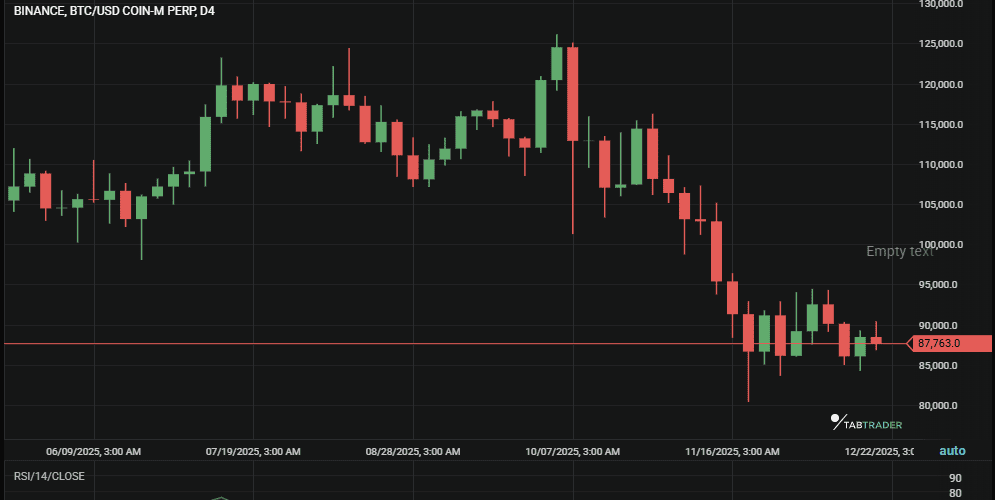

Bitcoin has been in repair mode. December has mostly been about finding footing rather than pushing for upside.

BTC/USDT

Key levels

Price has compressed into a narrowing range and continues to stall below the $90,000 area, which is acting more like a ceiling than a milestone.

The broader structure remains fragile. BTC is hovering around the $88,000–$89,000 zone, with price action leaning toward consolidation with a mild bearish tilt rather than a clean reversal.

From a level's perspective, $85,000 stands out as the key line in the sand on the monthly chart. A decisive loss there would likely expose the $75,000 region, where deeper demand is expected to sit. On the upside, $92,000 remains the level that separates short-term bullish attempts from continued distribution. Until that area is reclaimed, rallies should be treated cautiously.

Technical indicators

Momentum indicators are offering little in the way of clarity. Daily RSI is sitting near 52, which lines up with the lack of directional conviction. There is no meaningful divergence developing yet. Price is also interacting with the 50-day EMA, and repeated failure to hold above it would reinforce the current short-term downtrend.

Near term, the bias stays neutral. The more probable outcome for the week is uneven, back-and-forth trading between roughly $86,000 and $90,000 rather than a decisive move.

One final chart note worth keeping in mind given the calendar: low-liquidity holiday conditions often produce abrupt spikes followed by slow fades. A classic “Bart Simpson” shape would not be surprising in this environment, especially if volume thins out further.

Ethereum (ETH) snapshot

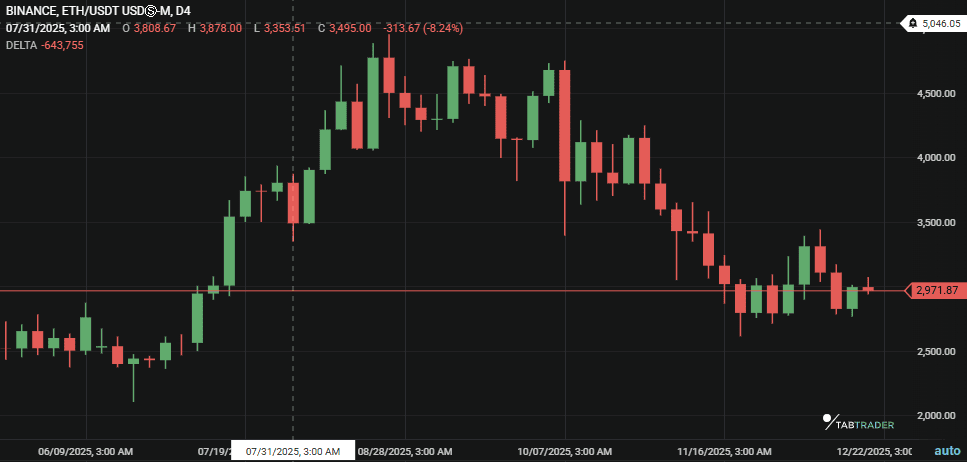

Ethereum continues to lag Bitcoin. Despite the successful Pectra upgrade earlier in the year, ETH has struggled to hold above the $3,000 level. The ETH/BTC ratio is still sitting near multi-year lows, which reinforces the same message the tape has been sending for months: institutional preference remains firmly tilted toward Bitcoin.

ETH/USD

From a behavior standpoint, ETH is showing relative weakness. It is trading like a high-beta extension of BTC, selling off more aggressively during downside moves and failing to keep pace when the broader market catches a bid. That asymmetry has been consistent and hard to ignore.

Key levels

Key levels are well defined. The $3,150 area is the level that needs to be reclaimed to change short-term momentum and shift sentiment away from defensive positioning. On the downside, $2,800 is the nearest support worth watching. A clean break there would likely trigger a fast move toward the $2,500 zone, especially in thin liquidity conditions.

Major Altcoin sector overview

Here’s how the different altcoin sectors played out this week:

- Layer 1 altcoins: Most L1s are bleeding slowly against BTC. SOL is holding up better than AVAX but lacks the volume to push new highs independently.

- DeFi: Uniswap (UNI) is the outlier this week. The Fee Switch proposal passing with ~62M votes is a massive catalyst, decoupling UNI from the broader market.

- Gaming: Risk-off sentiment hits this sector hardest. "Metaverse" tokens are seeing tax-loss harvesting selling pressure into year-end.

Altcoin sector takeaway

This week, DeFi is the only bright spot. While most sectors are suffering from liquidity withdrawals, the fundamental shift in Uniswap's tokenomics is attracting smart money, making it a defensive play against the general market chop.

Market metrics and sentiment indicators

BTC dominance

Bitcoin dominance continues to grind higher, now sitting around 59%. The message here is straightforward: capital is rotating defensively. Altcoins are steadily losing ground to Bitcoin, and that dynamic is unlikely to change unless BTC can reclaim and hold the mid-$90,000s. Until then, relative performance favors safety over speculation.

Market sentiment

Sentiment has cooled materially. The Fear and Greed Index is reading 25, placing the market back in “Extreme Fear” territory. This is a sharp contrast to the extreme optimism seen in October. There is a growing undercurrent of concern that the cycle peak may already be behind us, even if the longer-term structure has not fully broken.

Stablecoin flows are largely flat. There is no evidence of broad capital flight, but there is also no urgency to deploy risk. Funds are parked in USDT and USDC, waiting for clearer confirmation rather than chasing uncertain moves. In practical terms, that points to patience and selective positioning rather than aggressive exposure.

Key Events to Watch This Week

US Core PCE Data (Tuesday/Wednesday)

This is the only major event to watch on Christmas week. It is the preferred inflation gauge. If this comes in "hot," it kills hopes for a January rate cut and could send BTC testing $90k.

Possible scenarios for the upcoming week

Bearish case

The downside scenario activates if Bitcoin loses the $85,000 level with convincing volume. That would signal that December’s base-building attempt has failed. In that environment, altcoins are likely to see accelerated selling as risk is pulled quickly. Bitcoin would be exposed to the $75,000 area, while ETH would likely slide toward the $2,500 zone. This is the scenario where liquidity thins further and stops doing most of the work.

Neutral case

This remains the most likely outcome. Bitcoin continues to move sideways between roughly $86,000 and $91,000, with no sustained follow-through in either direction. Price action drags on, volatility compresses, and altcoins gradually underperform without a dramatic breakdown. This kind of market rewards mechanical, mean-reversion strategies and quietly punishes leverage. It is dull, but it fits the calendar.

Bullish case

The upside case requires a fast reclaim of $92,500 followed by a clean daily close above it. That would force late shorts to cover and could push BTC toward the $98,000 area. This outcome depends on an unexpected catalyst arriving during a week when most participants are offline. Possible, but not something to position aggressively for given the odds.

Bottom line

Capital preservation should be the priority, not squeezing trades out of thin liquidity. Post-correction nerves combined with holiday conditions create an environment where mistakes are amplified and edge is scarce.

The broader setup remains neutral with a bearish lean, and there is little incentive to push size while participation is this thin. Outside of broad market exposure, the one area worth monitoring is the DeFi “fee switch” discussion, particularly around UNI, which stands out as a rare idiosyncratic driver in an otherwise quiet tape.

For most traders, the practical approach is simple: stay patient, set alerts around $85,000 on the downside and $92,000 on the upside, and let the market come to you. If neither level breaks, there is no real cost to stepping away and letting the holidays pass.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.