Key takeaways

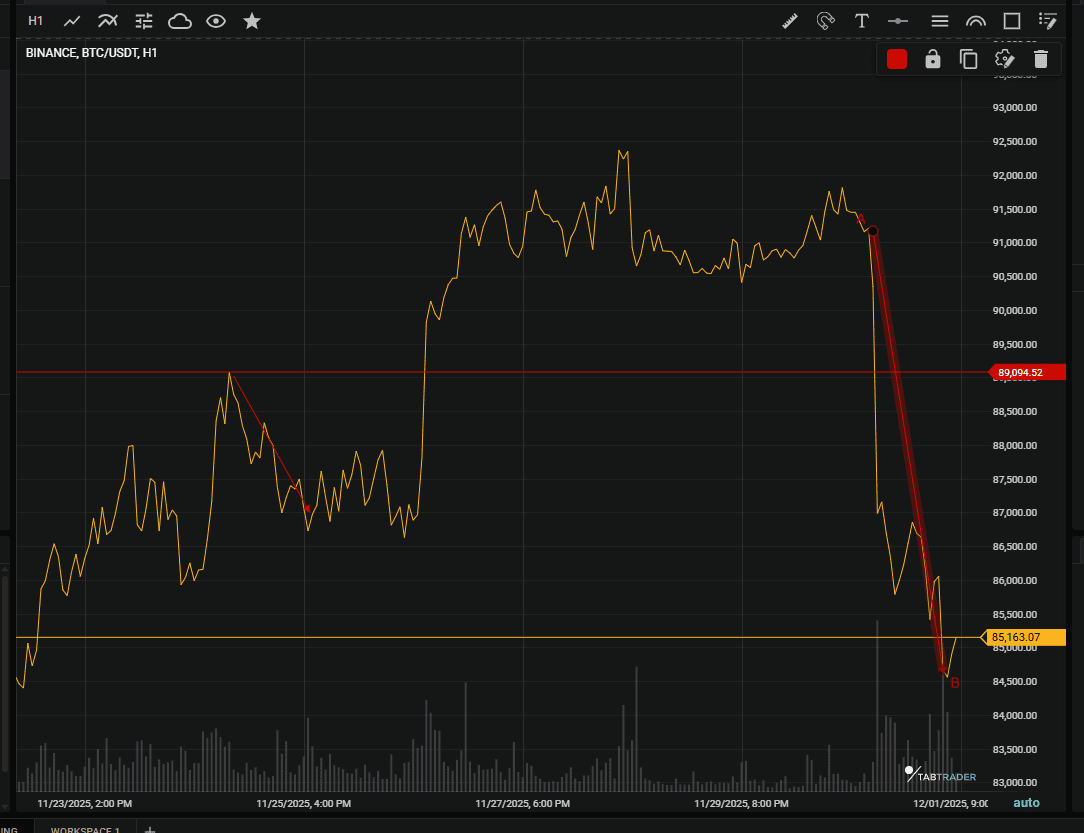

- Bitcoin broke the $91k–$88k consolidation zone early Monday, triggering a fast move lower.

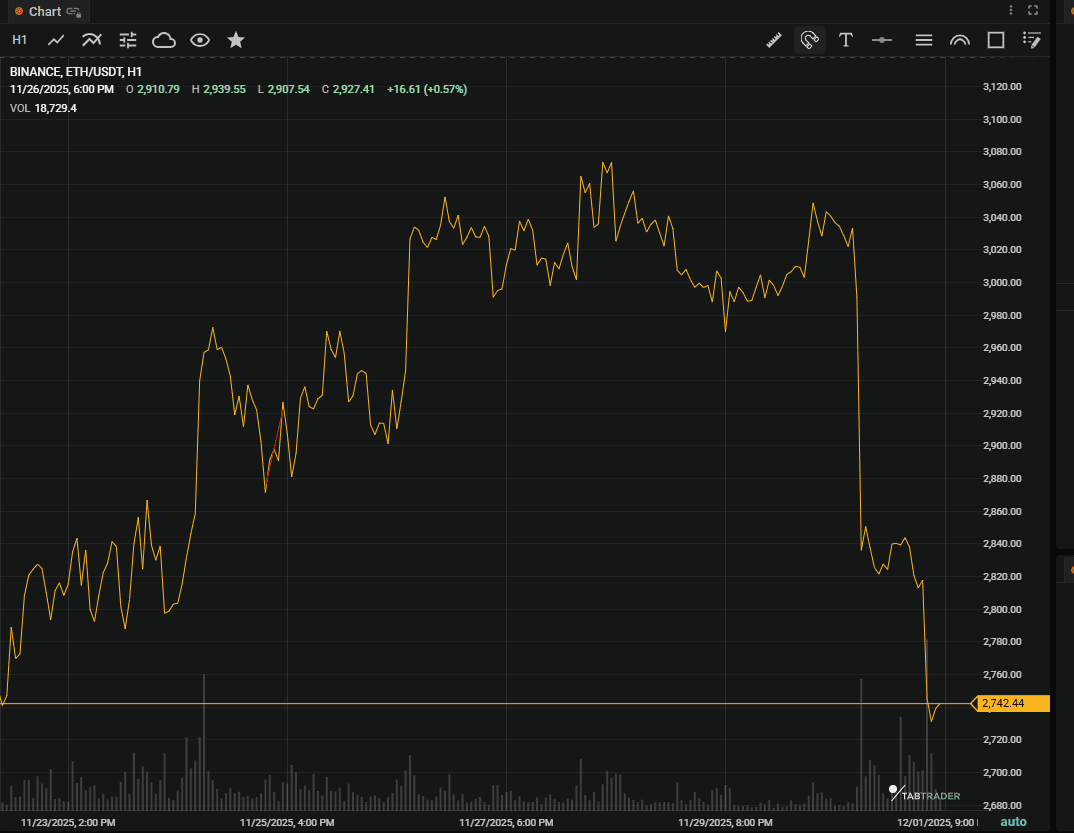

- Ethereum is down about 6% in the past day, and the ETH/BTC pair looks weighed down.

- Capital is rotating out of Layer-1 alts into stablecoins as BTC dominance rises to 59%.

Market overview

For Crypto, December isn’t exactly starting on a warm note. After weeks of drifting sideways, the market finally broke and not in a good way. Bitcoin slipped through a couple of important levels early Monday, and the rest of the market followed without much resistance.

The macro backdrop isn’t helping. The recent government shutdown left a trail of delayed economic reports, so traders are effectively working with patchy information. The NFP release may be pushed into mid-December, which means most positioning right now is happening in a bit of a data haze.

All attention is on Powell’s speech later today (Dec 1). With the next FOMC meeting coming up on Dec 9–10, everyone’s trying to figure out whether the Fed will actually go ahead with the expected 25bps cut, or hold back because the few inflation readings we have haven’t been particularly friendly. It’s one of those weeks where nobody wants to be caught leaning the wrong way.

Equities aren’t providing relief either. Asian markets and U.S. futures opened lower, and crypto once again moved in lockstep. At this point, the market is trading more like a high-beta extension of equities than anything resembling a hedge. Not ideal, but that’s the tape we’ve got.

Bitcoin (BTC) analysis

Bitcoin didn’t hold the $91k consolidation we saw late last week. The 4-hour chart on TabTrader shows a clean break below that range, and once price slipped through the $88k mid-range pivot, sellers pushed it downhill fast. The lower low that followed pretty much wiped out the short-lived bullish structure we had going.

Key indicators

- RSI: Sitting under 30. That usually opens the door for a relief bounce, but momentum is still pointed south. Oversold doesn’t mean “safe.”

- MACD: Daily MACD is widening on the bearish side. Selling hasn’t cooled off yet.

- Moving Averages: BTC is comfortably below the 20-day SMA now. If we do get a bounce, the 50-day SMA is the first real test.

Key levels

- Resistance: $89,500 (previous support flipped resistance), $92,000 (range high).

- Support: $85,500 (immediate wick support), $80,000 - $82,000 (major psychological and structural support zone).

Ethereum (ETH) snapshot

Ethereum isn’t keeping up. It’s down about 6% in the past day, and the ETH/BTC pair looks weighed down, still unable to catch any meaningful liquidity even with the market whipping around. The pair keeps drifting lower, which isn’t doing ETH any favors on the dollar chart.

Key levels

- Support-$2,800: This is the line ETH really needs to hold. A daily close below it puts $2,650 back on the table.

- Resistance- $3,000: Big psychological level and the first step toward undoing the short-term bearish tone.

ETH/USDT

Ethereum December outlook

Probably best to stay patient here. ETH needs to either reclaim $3,000 or drop into the $2,650 demand zone before long setups make sense again. Right now, it’s just sliding, and forcing trades in this kind of tape usually ends with regret.

Major Altcoin sector overview

Layer 1 Protocols (SOL, ADA, AVAX)

The outlook for major Layer 1s is currently Bearish. We are seeing a distinct rotation of capital out of alternative L1s and into stablecoins, driven largely by rising Bitcoin dominance which is sapping altcoin liquidity. Traders should monitor Solana (SOL) closely; if Bitcoin fails to hold the $85k level, expect SOL to test lower support zones aggressively.

DeFi Ecosystem (UNI, MKR, AAVE)

DeFi tokens are showing a Neutral to Bearish trend. The sector remains heavily correlated to Ethereum’s performance, meaning no significant breakout is imminent without renewed ETH strength. However, AAVE continues to show relative resilience, acting as a "safe haven" play compared to its peers like Uniswap and Maker.

Gaming & Metaverse (SAND, MANA)

Sentiment for Gaming remains distinctly Bearish. Risk appetite for high-beta metaverse tokens is non-existent this week as the market prioritizes safety. Expect assets like SAND and MANA to underperform Bitcoin by a wide margin until broader market confidence returns.

Capital is leaving speculative sectors (Gaming, L1s) and moving into USDT/USDC. No sector is currently outperforming BTC.

Sentiment indicators

Fear & Greed Index: 24 (Fear)We’ve slipped out of “neutral” and back into fear territory. That shift can turn into a counter-trend buying opportunity if price stops falling and finds its footing. Until then, it’s just a warning light. Worth noting, but not something to chase.

BTC Dominance: RisingNo surprise here. During corrections, Bitcoin usually bleeds slower than everything else, and that’s exactly what we’re seeing. Altcoins are getting hit harder, and the whole “alt season” narrative stays on ice until BTC settles down first.

Key events to watch this week

Mon, Dec 1: Powell Speaks

High-volatility day. Markets will hang on every word, mostly because traders are still guessing how firm the Fed is about that December rate cut.

Tue, Dec 2: JOLTS Job Openings

Labor market softness is the Fed’s pressure point right now. A weak reading could oddly help risk assets. One of those “bad news, good reaction” situations that feels counterintuitive but tends to play out when policy expectations are in flux.

Wed, Dec 3: ADP Employment Data

Not as influential as the official NFP report, but still enough to nudge expectations around the edges.

Fri, Dec 5: Core PCE (Delayed)

This is the Fed’s preferred inflation metric. If it pops above ~2.8%, the market likely leans bearish into the following week. Nobody wants to see this one come in hot, but it’s a possibility traders have to keep in mind.

Note: The official NFP report may slip to Dec 16 because of the recent data-collection delays, so the labor picture could remain blurry longer than usual.

Possible BTC scenarios

Bearish Scenario

If BTC slips under the $85,500 support on the 4H chart, the market could tumble into a quick liquidation wave. The next real landing zone sits around $80,000–$82,000. Altcoins would probably take the hit harder, with another 10–15% downside on the table.

Neutral Scenario

If BTC can claw back to roughly $86,500, we might get a slow, choppy range between $86k and $89k for the rest of the week. It’s the sort of environment where nothing feels urgent, and the market just drifts while everyone waits for next week’s Fed meeting. A small relief bounce would help reset the RSI, but that’s about it.

Bullish Scenario

A dovish tone from Powell could give BTC a quick shove back above $90k. That would be a start, but it’s not enough on its own. A daily close above $92,000 is what actually signals that the correction might be behind us. Until then, any upside should be treated as a bounce, not a trend change.

Bottom line

This is one of those weeks where doing less is probably the smarter move. With key support breaking and the macro calendar still jammed up by delayed data, the market doesn’t have a clear direction yet and pretending it does usually leads to bad decisions.

The drop below $88k matters. Until Bitcoin either tests and steadies near the $82k zone or manages to win back $89.5k, the best approach is simple: protect capital and treat every setup with suspicion. Week 1 of December is shaping up to be more about survival than opportunity, and there’s nothing wrong with sitting tight while the market sorts itself out.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.