Key takeaways

- Crypto crash has wiped out gains and shaken the market. The near-term bias for Bitcoin is completely bearish. Below $80k, rallies look tactical and short-lived.

- The crash is primarily driven by the nomination of hawkish former Fed Governor Kevin Warsh as the next Fed Chair, which has sparked fears of tighter liquidity, slower rate cuts, and a stronger USD, prompting a broad sell-off across risk assets, including crypto.

For crypto, the early-January optimism is fading. The market has slipped into a defensive stance, and risk appetite has cooled across the board. The recent crash has effectively wiped out recent gains and shaken the crypto market. Bitcoin is leading the charge, with CoinGlass data revealing that investors have liquidated $2.5 billion in recent days.

The expected nomination of Kevin Warsh as the next Fed Chair has unsettled currency and metals markets. Even though the FOMC left rates unchanged, the messaging leaned hawkish enough to pressure risk assets. Traders are treating this as a reminder that policy easing is not imminent.

Tensions in the Gulf have pushed Brent crude above $71 per barrel. Higher energy prices reintroduce inflation concerns and complicate the Fed’s outlook, which is the last thing risk markets want to deal with right now.

Capital is rotating toward the U.S. dollar and short-duration treasuries. Bitcoin, for now, is being traded more like a leveraged growth asset than a defensive hedge. That framing matters for short-term price action, even if the long-term narrative hasn’t changed.

Bitcoin (BTC) analysis

Crypto markets sold off hard over the weekend, with a fast, thin-liquidity drop that pushed Bitcoin back to levels last seen in late 2024. Liquidations did most of the damage once stops started tripping, and price moved faster than sentiment could adjust.

The macro catalyst came shortly after President Donald Trump announced Kevin Warsh as his nominee for the next Federal Reserve Chair. That headline accelerated the sell-off.

Crypto reacted negatively because Warsh has a long track record of favoring tighter liquidity conditions, and markets reacted accordingly. For crypto, the implication is straightforward: tighter liquidity means fewer marginal buyers, especially on leverage.

Bitcoin has now lost the $80,000 level. That zone mattered. It acted as a base late last year and held multiple pullbacks. Once it broke, there was no attempt to reclaim it. Price slid directly into the broader 2024–2025 support range, which is now doing the heavy lifting.

BTC price movement.

Support levels

- $74,425: The 10-month low and the nearest level that needs to hold to prevent further damage.

- $70,000: A structural level. A clean break below would shift the market from a correction into something more involved.

Resistance levels

- $80,000: Former support, now a crowded supply zone where sellers are likely waiting.

- $82,500: The next area that would need to cleared before any meaningful trend repair can begin.

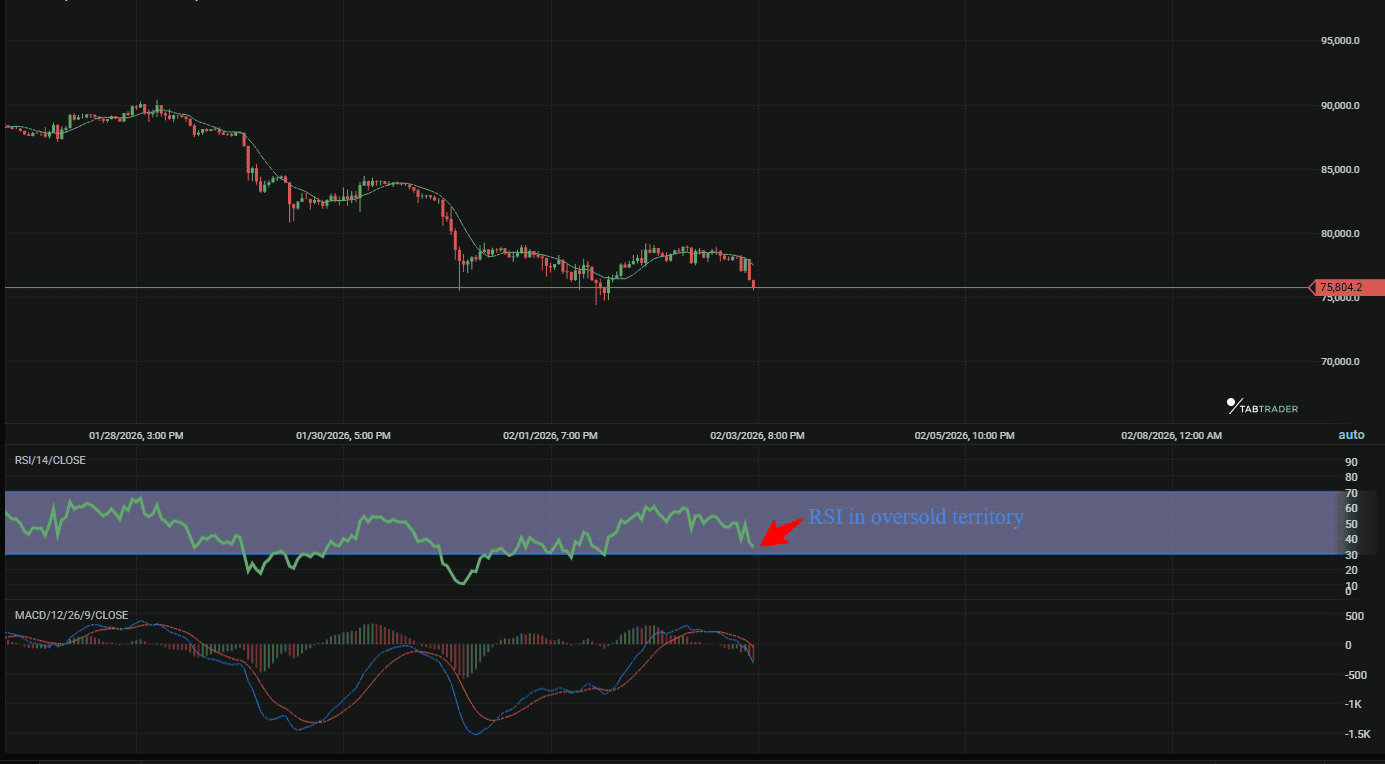

Momentum and indicators

- RSI: Sitting near 40. Selling pressure is moderating, but the market isn’t stretched enough to force a bounce.

- MACD: A bearish crossover on the daily, with momentum still pointing lower rather than flattening out.

Near-term bias

The near-term bias for Bitcoin is completely bearish. Below $80k, rallies look tactical and short-lived. Risk reduction makes more sense here than chasing upside.

Tabtrader chart note

On the 4H TabTrader chart, the price is pinned to the lower Bollinger Band. A falling wedge is forming, but it lacks confirmation. Buy-side volume remains light, and follow-through has been poor. A brief wick into the $74k area would fit the current structure and likely flush remaining late longs before any attempt at stabilization.

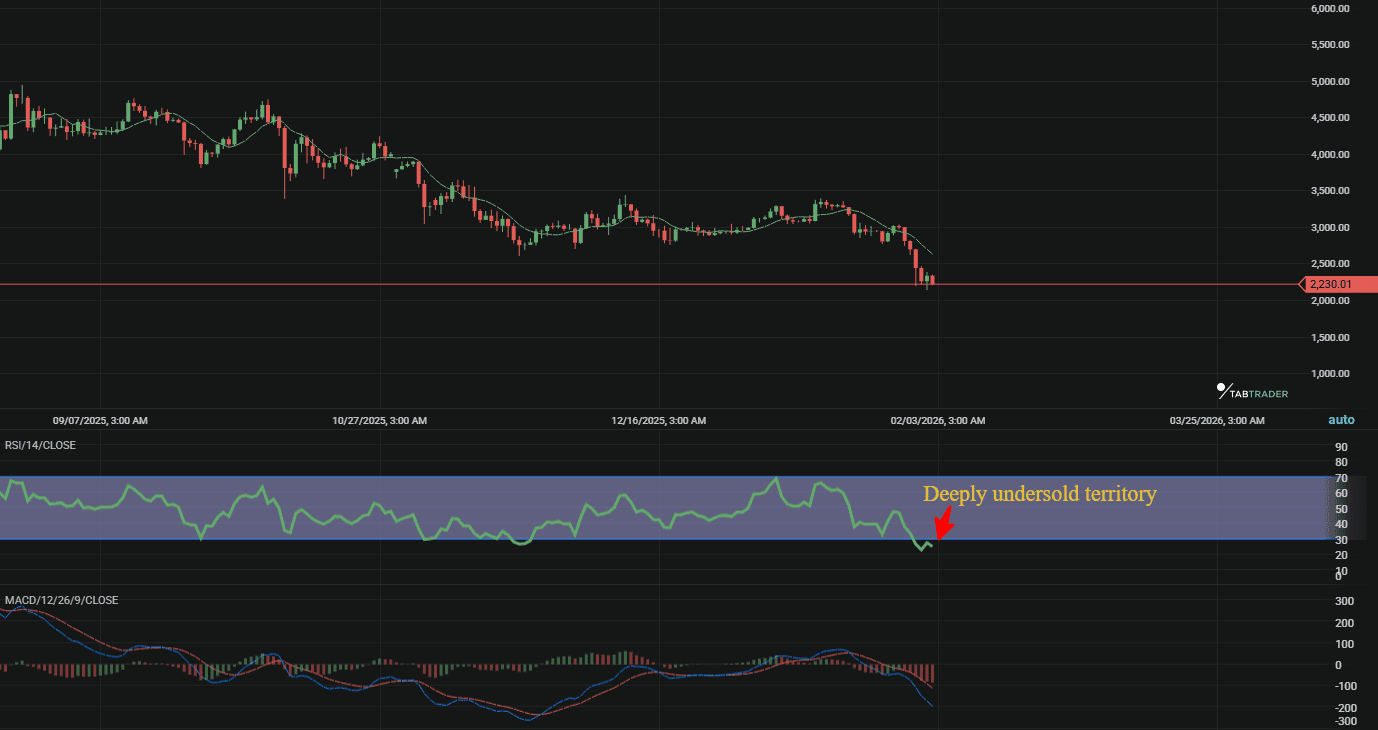

Ethereum (ETH) snapshot

Ethereum has weakened quickly over the past few sessions. The move hasn’t been subtle, and it hasn’t been orderly.

As broader sentiment turned defensive, ETH absorbed more damage than most large-cap peers. Part of the pressure is structural. Part of it is deliberate selling. Large holders have been active, and not in a supportive way.

Case in point, over the past week, wallets holding between 10,000 and 100,000 ETH reduced exposure aggressively, unloading more than 1.1 million ETH. At current prices, that distribution clears $2.8 billion. That kind of supply doesn’t disappear quietly.

Relative performance tells the same story. ETH has become the underperformer among majors. The ETH/BTC ratio has slid to 0.029, a level not seen in a long time, as capital rotates back toward Bitcoin’s relative stability. This isn’t about Ethereum’s long-term fundamentals. It’s about where traders want to park risk right now.

Key levels

This week, $2,200 matters. A daily close below it opens the path to a fast move lower, with $1,950 emerging as the next realistic downside magnet if momentum accelerates.

At this point, ETH needs time and reduced selling pressure before any constructive setup can form. Neither is in place yet.

ETH price movement.

Major Altcoin sector overview

Layer 1 altcoins

Layer 1s are holding up better than most, but that’s a low bar this week. Solana is still defending the $155 area, which stands out amid ETH’s weakness, though its usual high beta has faded. The trades here feel defensive rather than conviction-driven.

DeFi tokens

DeFi remains under pressure as liquidation risk hangs over lending protocols. With volatility elevated, few traders are willing to step in front of that risk. Capital preservation is the priority, and DeFi isn’t offering much shelter right now.

Gaming tokens

This is where the damage is concentrated. These names attracted speculative flows on the way up and are now absorbing the exits. Drawdowns of 15% or more are common as short-term capital heads for the door. Liquidity is thin, and patience is limited.

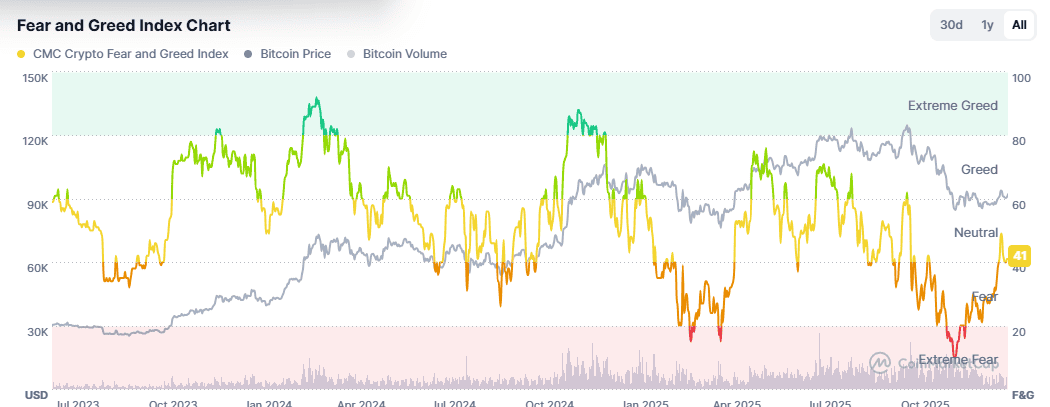

Sentiment indicators

Fear/Greed Index: 15 (Extreme Fear). Last week, we were at 45 (Neutral). This is a massive sentiment shift that usually precedes a "relief rally," but the knife is still falling

courtesy of CMC.

Key events to watch this week

- Tuesday, RBA Interest Rate Decision The Reserve Bank of Australia often acts as an early signal for broader risk appetite. Any surprise here tends to spill over into global markets, even if the direct impact on crypto is indirect.

- Wednesday, ISM Services PMI This release will help clarify whether the U.S. economy is slowing in an orderly way or starting to lose momentum. Markets are sensitive to that distinction right now.

- Friday, U.S. Non-Farm Payrolls (NFP).

Possible scenarios for the coming week

Bearish scenario

This scenario will play out if Bitcoin fails to hold the $74,400 area, and the downside could accelerate quickly. A move toward $70,000 becomes likely as stops get triggered and liquidity thins out. In that environment, ETH slipping below $2,000 would be hard to avoid, and total market capitalization could compress toward the $2.3T range.

Bullish scenario

An $80,000 reclaim would require a real catalyst, not just short covering. A clearly dovish macro signal or a sudden surge in stablecoin inflows could do it. If that happens, shorts would be caught offside, and a fast move back toward the $85k area becomes plausible.

Neutral case

A Bitcoin holding between roughly $74,500 and $78,000 would signal a pause rather than continuation. This kind of week wouldn’t look impressive on the surface, but it would ease pressure. Altcoins could stop bleeding, and some names may start carving out local lows.

The bottom line

This week calls for patience because volatility is elevated, leverage is being flushed out, and patience matters more than prediction. For newer traders, this isn’t an environment that rewards activity. Sitting on the sidelines and watching how price reacts is a valid choice.

For more experienced traders, the focus stays narrow: the $74.4k area on Bitcoin. If that level holds through Friday’s NFP release, the market may be in the process of carving out a local low. Until that’s confirmed, there’s no urgency. Holding cash or stablecoins is still a position, and right now it’s one with optionality.

Don't guess. React. Set your alerts on TabTrader now.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.