Crypto Market Outlook: Bitcoin Is Leading the Crypto Market Retreat, Amid Escalating Global Trade Turmoil.

Key takeaway

- Bitcoin has extended losses, down approximately 2-3% over the past 24 hours (from recent levels around $92,500-$93,000), trading near $91,000-$91,200 as of mid-morning UTC, with lows dipping to around $90,600-$90,700 in some sessions.

- Tariff threats have broadened (now explicitly linked to Greenland acquisition demands), pushing capital further into defensive mode, with safe-haven assets like gold continuing higher, while high-beta assets like crypto face outflows.

- The week remains defined by two forces: escalating geopolitical risk versus potential institutional support.

Crypto market overview

After a week of steady gains, Bitcoin’s shakeout has accelerated into a more pronounced pullback, erasing recent gains and testing lower supports. For seasoned crypto traders, it is a familiar shakeout, set off by geopolitical headlines. Most importantly, a reminder that despite the market’s growing sophistication, macro sentiment still runs the show when risk conditions change quickly.

To summarize, the week opens with a clear tilt toward risk-off with most top assets in the red.

Crypto macro backdrop

U.S. markets are back open after Martin Luther day break, but sentiment is defensive after tariff escalations over Greenland. European stocks saw sharp drops (biggest daily drop in 2 months), and U.S. futures weakened. This has amplified uncertainty, with traders wary of further rhetoric (e.g., from Davos discussions). While some de-escalation occurred earlier in January (e.g., Iran-related), the current trade focus dominates

Equities sentiment

Nasdaq futures are down around 1.8%. At the same time, traditional safe havens are catching a bid, with gold and silver gapping higher to fresh record levels. The message is straightforward: capital is rotating out of risk, at least for now.

Crypto reaction

Crypto is trading firmly as a high-beta risk asset rather than a hedge. Correlation with equities has picked up as traders reduce exposure ahead of a crowded U.S. earnings calendar, Netflix, Visa, and Intel among the highlights, and Thursday’s PCE inflation release. In this environment, crypto is responding to the same pressures as tech stocks, not carving out its own narrative.

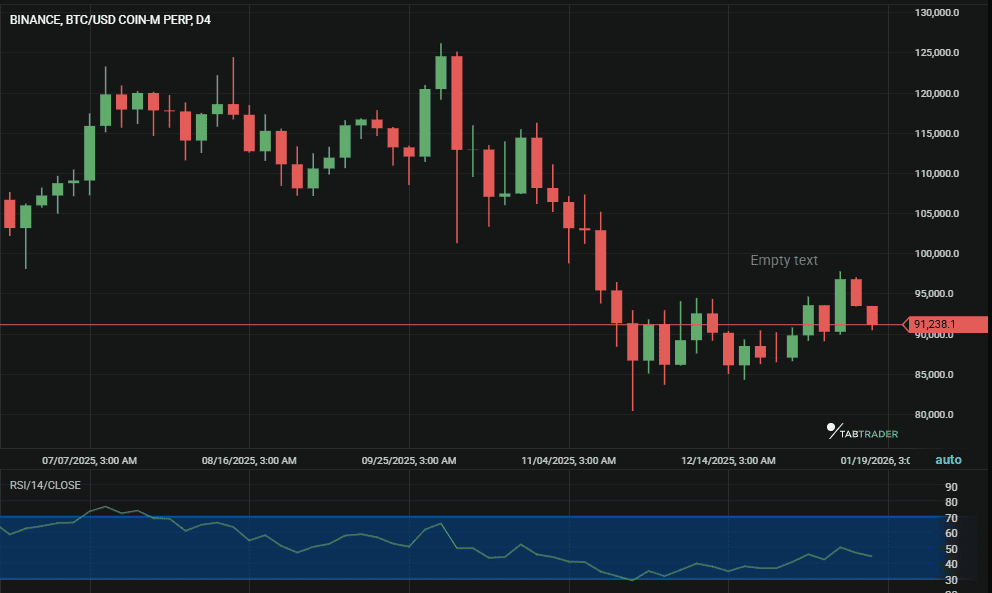

Bitcoin (BTC) analysis

BTC has lost the $92,000-$93,000 area more decisively, trading around $91,000-$91,200 (with intraday lows near $90,600-$90,700). The pullback is controlled but seller-driven, with $90,000 now looming as a pivotal zone.

Short-term pressure is clearly bearish, while the medium-term structure remains unresolved. BTC topped near $97,000 last Wednesday and has since drifted lower, trading around $92,500 this morning. The move has been controlled rather than panicked, but sellers are dictating the pace.

Key levels this week

- Support: $90,355-$91,000). A clean break below $90,000 could accelerate toward mid-$80,000s.

- Resistance: $92,000-$93,000

BTC/USDT.

Momentum readings

RSI is sliding toward the mid-50s, reflecting fading bullish momentum without signaling exhaustion. MACD has rolled over on the 4H chart, confirming the short-term trend shift rather than leading it.

Near-term bias

Neutral to bearish over the next 48 hours. With U.S. markets closed today, price is likely to chop around the $92k area until liquidity improves on Tuesday.

Tabtrader chart note

The $91,900 zone matters. Pay attention to the wick behavior there. A clean 4H close below that level would change the conversation quickly and put a deeper retrace back toward the low $80,000s on the table, a zone we have not revisited since the Q4 2025 pullback.

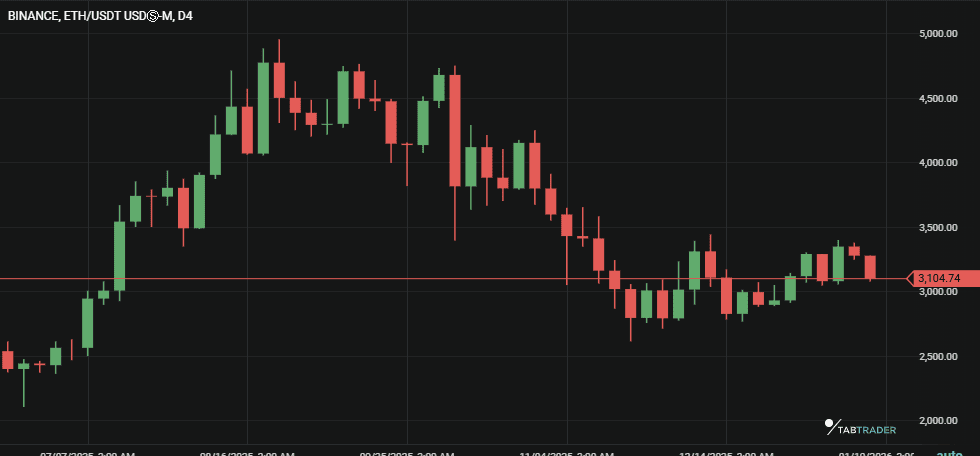

Ethereum (ETH) snapshot

Like last week, Ethereum continues to trade in Bitcoin’s shadow, with little to suggest near-term independence.

The ETH/BTC ratio is still hovering near multi-year lows. On a day when Bitcoin is down roughly 3%, ETH is off closer to 5%. That spread tells the story. When risk comes off the table, ETH tends to feel it first and more sharply.

ETH is holding around the $3,300 zone, though “holding” may be generous given the broader tape.

Key levels

- Support: $3,000

- Resistance: $3,450

ETH/USDT

Future outlook

The market is largely waiting on the Glamsterdam upgrade later this quarter, which aims to improve Layer 1 efficiency. Until that catalyst moves closer, ETH lacks a reason to lead. For now, it remains a rotation trade, something traders look at after BTC stabilizes.

Major Altcoin sector overview

Layer1s

SOL led early last week, topping near $148, but that strength has faded. Price is now probing the $135 support area, which will decide whether this is a pause or a rollover.

DEFi

Larger-cap DeFi continues to hold up better than most. Capital is sticking with names that feel established rather than chasing newer L1 narratives. Institutional "Blue Chip" DeFi is holding value better than speculative L1s.

Gaming/ Metaverse

This high-risk sector is seeing the heaviest outflows during this tariff scare. This is where risk-off shows up first. Flows are moving out quickly as traders reduce exposure to higher-volatility themes.

Altcoin sector takeaway

DeFi is acting as the closest thing to a defensive corner within altcoins. Total Value Locked is holding around $209B despite recent price pressure, which suggests core users are staying put rather than pulling yield. That contrasts sharply with gaming and metaverse tokens, which continue to lag. Those sectors depend on speculative appetite, and right now, that appetite is limited.

Market metrics

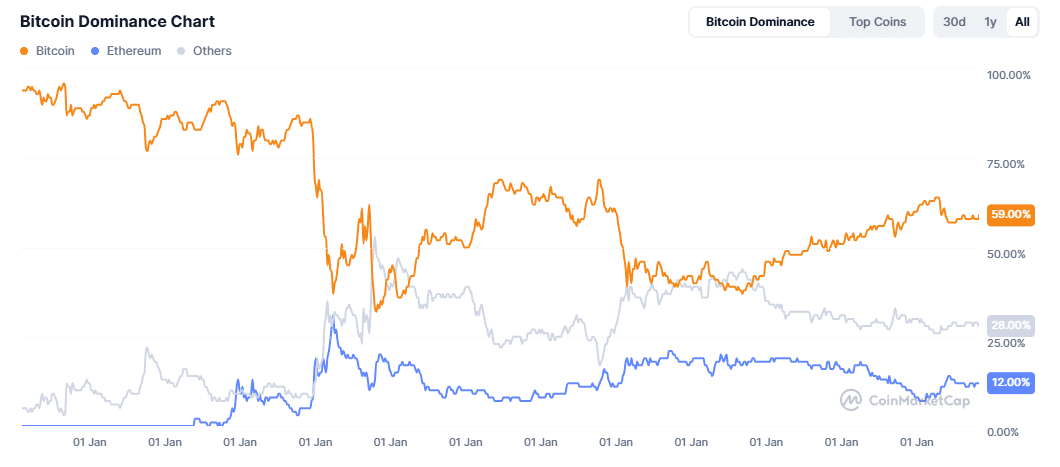

BTC dominance

59% and rising. During periods of uncertainty, capital tends to consolidate at the top of the market. That shift is visible again, with liquidity rotating out of altcoins and back into Bitcoin.

Source: CMC

Fear & Greed index

Neutral 45. The index has cooled quickly from last week’s reading near 65. That kind of reset usually leads to range-bound trading rather than immediate trend continuation.

Stablecoin liquidity

Total stablecoin market cap sits around $311B, a record level. Capital has not left the ecosystem; it is parked and waiting. Once macro conditions stabilize, that sidelined liquidity becomes fuel, but timing matters more than availability here.

Key events to watch this week

- Tuesday, Jan 20: U.S. ADP Employment Change. Labor data will help frame expectations for Thursday’s inflation print.

- Thursday, Jan 22: Core PCE inflation, the Fed’s preferred gauge, alongside the final Q3 GDP estimate. This is the macro focal point of the week.

- Friday, Jan 23: Earnings from major technology firms and payment processors. Results and guidance will feed directly into broader risk sentiment.

Possible scenarios for the coming week

Bearish case

An escalation in tariff headlines, combined with a core PCE print above 0.2%, would likely push Bitcoin to $91,900. In that setup, price could slide toward the mid-$80,000s as late long positioning gets cleared out.

Neutral case

Bitcoin remains range-bound between roughly $92,000 and $95,000. With U.S. markets reopening on Tuesday, the focus shifts to whether institutional ETF flows step in or stay on the sidelines. Until then, expect noise rather than direction.

Bullish case

A sustained reclaim of $97,000 on strong volume would signal that buyers have regained control. That outcome likely requires some cooling in trade tensions. If it happens, a push toward the $100,000 area becomes reasonable, not immediate, but back on the radar.

Bottom line

This week comes down to two opposing forces: trade-related headline risk and the depth of institutional demand waiting in the background.

The pullback driven by tariffs is uncomfortable for short-term positioning, but the broader structure has not broken. Stablecoin liquidity remains at record levels, which matters more than intraday noise. Capital has stepped aside, not exited.

For less experienced traders, this is primarily an observation week. Let levels resolve before taking risks. More active participants can start mapping potential bottoms in ETH and SOL near $3,000 and $130, respectively, but only if Bitcoin stabilizes and holds its key support. Without that, patience remains the higher-probability trade.

Trade Smarter. Scan these levels live in TabTrader.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.