Crypto Market Weekly Outlook: A Fragile Calm After the Sell-Off

Key takeaways

- Bitcoin has bounced back from its $60,000 lows and some institutional demand suggests a possible local bottom near current levels. Technical indicators show the market is less oversold, and selling pressure is easing.

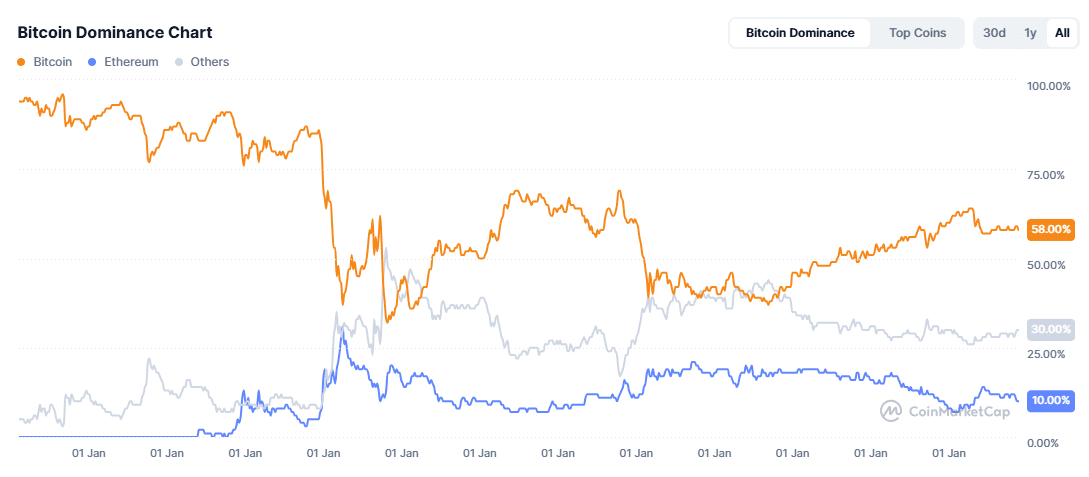

- Bitcoin is likely to outperform altcoins as its dominance approaches 59% and fear remains high in the market. Investors are moving toward safer assets in this cautious environment.

- DeFi tokens may show some resilience because of their utility and yield, but high-risk sectors like gaming are still under pressure.

The crypto market is finding some stability after last week's sharp selloff caused by liquidations. However, factors like a strong U.S. dollar, risk aversion, and upcoming U.S. economic data are keeping investors cautious. Bitcoin has recovered from its Friday low near $60,000 but is still volatile and trading below recent levels. Altcoins are feeling even more pressure in these risk-off conditions.

Overall, market sentiment is cautious to defensive. Stocks are performing better than expected, but crypto is still dealing with the fallout from early February’s liquidations. The market is still processing that event.

Crypto investors have become more cautious, moving their money back into Bitcoin. This shift is clear in alt/BTC trading pairs, where most altcoins are losing ground. Investors are simply looking for the safest place to wait out the uncertainty.

Bitcoin (BTC) analysis

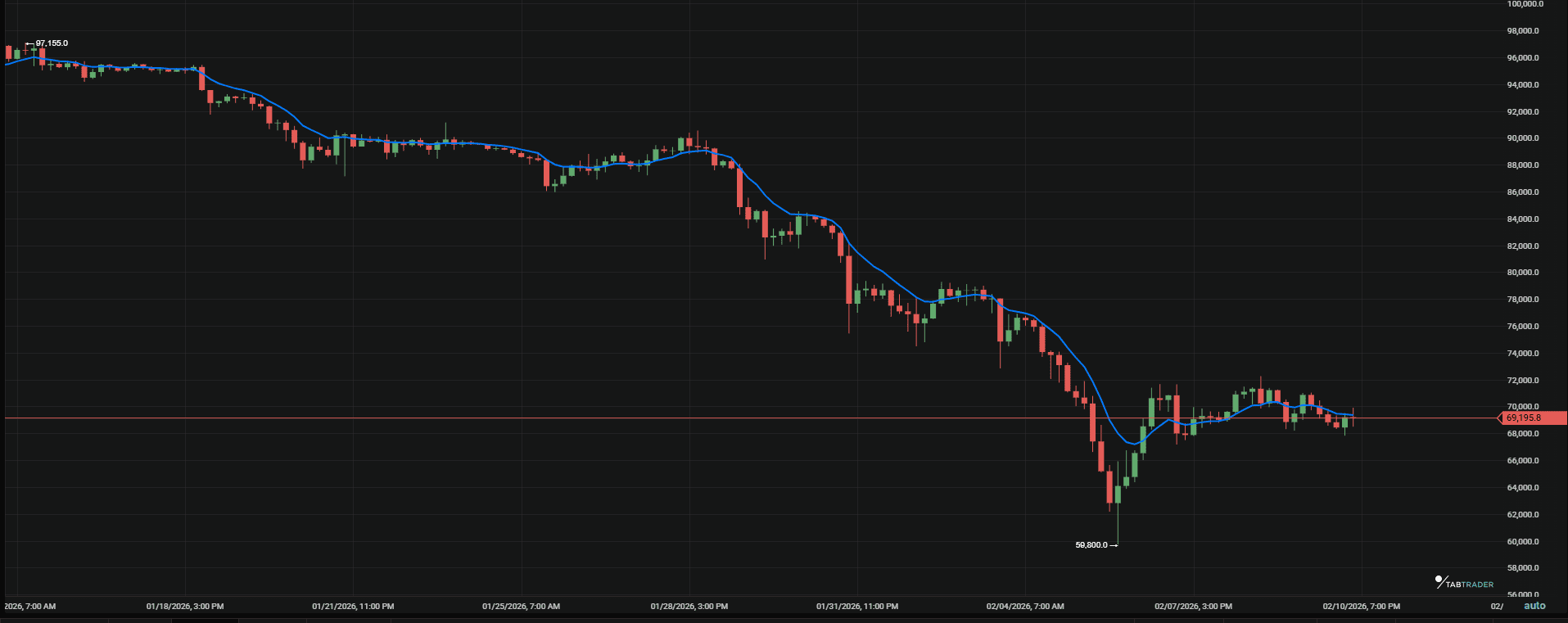

As of February 10, 2026, Bitcoin is trading between $68,900 and $69,500 after briefly dropping below $69,000 earlier in the day. Earlier in the week, it tried to move above $70,000 but could not hold that level.

Now, the price is moving sideways between $67,300 and $71,751 after a sharp drop caused by forced liquidations. This was one of the biggest declines since late 2022, with Bitcoin falling almost 50% from its October 2025 peak near $126,000 before recovering some of its losses.

BTC/USDT 4-hour chart.

The market is still recovering and remains in a medium-term downtrend. Oversold conditions have improved, as shown by the RSI moving up from very low levels. On-chain data also shows some early signs of stabilization, such as small ETF inflows and some corporate buying. However, momentum indicators like the MACD are still negative on daily and 4-hour charts, and resistance is limiting any upward movement.

Support levels

- Major support: $67,300 (lower range boundary) holds as the immediate buffer; a break could target $65,520 (Fib retracement) or retest the $60,000 low, risking further deleveraging.

- Major Resistance: $71,751–$73,072 (recent highs and supply zones); clearing these would require stronger demand.

Near-term bias

In the short term, the outlook remains slightly positive as long as Bitcoin stays above $68,000. If that happens, a move toward $75,000 is possible. Going higher than that would probably require help from broader economic factors.

Ethereum (ETH) snapshot

Ethereum continues to lag behind Bitcoin, flirting with the psychological $2,000 level. While holding above support, the lack of immediate recovery momentum is concerning.

ETH/BTC is also in a downtrend and near multi-year lows. Institutions are paying less attention to Ethereum, and pressure on altcoins in general has left Ethereum in a middle position, doing better than high-risk altcoins but still behind Bitcoin.

ETH/USD 4-hour chart.

Key levels

- Support: $2,000 must hold to avoid deeper weakness.

- Resistance: $2,240–$2,300 sellers remain active.

Major Altcoin sector overview

Layer 1 altcoins

Layer 1s are drifting sideways. Solana has been slow to respond to the broader bounce and remains deeply negative on the year, while Avalanche has stabilized but hasn’t attracted fresh momentum. Cardano has been the outlier, picking up bids on the back of CME futures headlines rather than organic risk appetite.

DeFi tokens

DeFi is holding up better than most. Names like AAVE, UNI, and MKR have been among the first to bounce, helped by renewed interest in Real World Asset narratives and yield-focused positioning. In a market that’s still cautious, predictable cash flow beats speculation.

Gaming tokens

Gaming and Metaverse tokens continue to leak. These are high-beta trades, and with risk appetite still muted, they’re being sold to raise liquidity rather than accumulated. Until retail activity shows signs of returning, this corner of the market likely stays under pressure.

Altcoin summary

DeFi is leading the altcoin recovery as capital rotates toward assets with yield and utility. Gaming remains the weakest link, and Layer 1s are stuck waiting for a clearer risk-on signal.

Sentiment indicators

BTC Dominance: Rising toward 59%. This indicates we are firmly in "Bitcoin Season." Capital is rotating out of Alts and into BTC to weather the macro storm.

BTC dominace. Courtesy of CMC.

Fear/Greed Index: 9 (Extreme Fear). This is the lowest reading since the 2022 bear market. Historically, this is a "buy when there's blood" signal, but wait for the macro data before going all-in.

Key events to watch this week

- Wednesday, Feb 11: Rescheduled Jan Non-Farm Payrolls.

- Friday, Feb 13: US CPI Inflation (might determine the Fed’s next rate path).

Possible scenarios for the coming week

Bullish case

If Bitcoin stays above $70,000 and breaks through the $75,000 resistance, it will probably need a lower-than-expected CPI report on Friday to help risk assets. If this happens, Bitcoin could move toward the low $80,000s, with $82,000 as the first target, but not necessarily the final one.

Neutral case

In the neutral case, Bitcoin’s price moves between about $66,000 and $72,000 as the market waits for more direction from the Fed. Volatility drops, momentum slows, and most altcoins move sideways along with Bitcoin.

Bearish case

If inflation or jobs data is higher than expected, Bitcoin may fall below $68,000 and head back toward $60,000. Altcoins would likely drop even more, possibly losing another 15 to 20 percent as liquidity dries up.

Bottomline

This week, it’s important to focus on the bigger picture and avoid reacting impulsively. Early price moves after Tuesday’s retail data are probably just noise. The market’s direction should become clearer after Wednesday’s jobs report and Friday’s CPI numbers.

If Bitcoin stays above $68,000 by the end of the week, it would be a positive sign. While this wouldn’t confirm a new uptrend, it would suggest that the recent selloff has probably created a local bottom. For now, being patient is more important than trying to time every move.

Don't guess. Instead, respond to what happens. Set your alerts on TabTrader now and let the price come to you.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.