Key takeaways

- Why is Crypto going down? Liquidity is thinning, risk appetite for risky assets is fading, and spot ETF flows briefly turned negative. The Market cap cap now stands at $3.2T.

- Bitcoin has decisively broken below the $100,000 psychological floor, its first close under this level in 189 days, triggering a 25% drawdown from its October 6 all-time high of $126,080.

- Sentiment data shows rising fear and uncertainty among retail investors, while the Fear and Greed Index has fallen to its lowest level since February, signaling extreme market fear and an elevated potential for a sentiment-driven reversal.

- If Nvidia’s earnings disappoint on Wednesday, the whole market might take another step down.

Market overview

Risk appetite for risky assets continues to fade. The U.S. government shutdown is in the rearview mirror, but the economic hangover is very much still here. The latest Fed minutes didn’t do bulls any favors either; rate cut hopes for December cooled off fast.

Two things are steering the macro conversation this week: Flash PMI data and Nvidia earnings. Nvidia has become the unofficial heartbeat of the tech sector, so traders are watching it like it’s the season finale of a show they’re way too invested in.

Crypto hasn’t broken free from equities lately. Correlation is tight again, and with the S&P under pressure, liquidity in major crypto assets is thinning out.

Also, Spot ETF flows flipped negative over the weekend. That whole “buy the dip” vibe has turned into more of a “sit on your hands and wait” mood.

Bitcoin (BTC)

Bitcoin losing the $100,000 psychological floor didn’t just sting. It flipped the market from a confident “buy the dip” mindset into a cautious “don’t lose your stack” mode.

Adding to the pressure, the daily chart printed a Death Cross (50-day SMA dropping below the 200-day). It’s a lagging signal, sure, but when it shows up, it usually means one thing: the next few weeks won’t be fun for bulls.

So, why is Bitcoin going down?

Bitcoin is going down primarily because it failed to defend the key $100,000 psychological support level, which triggered forced selling and a shift from a confident “buy the dip” mindset into a more cautious “don’t lose your stack” mood, while its strong correlation with declining equities is intensifying risk-off flows and weak liquidity is resulting in fewer bids and deeper drops.

BTC/USDT

Starting Monday 17th, BTC is oscillating between $94k–$95k, struggling to attract strong bids. The rejection near $98,500 over the weekend confirmed this level as new resistance, and price action inside a descending channel continues to cap upside attempts.

Our analysis confirms that BTC is stuck in a descending channel, and the failed push into $98,500 over the weekend confirmed that support has fully turned into resistance. Price feels heavy, like every rally attempt has sandbags tied to it. Liquidity really only shows up when we get closer to the low-$90k range.

Key levels

- Resistance: $100,000 (the line everyone’s watching), then $106,000.

- Support: $90,000. If this breaks, mid-$80ks are suddenly on the menu.

Indicators

- RSI: Daily RSI is under 35. Oversold, but still not showing any real momentum shift.

- MACD: Weekly MACD is firmly bearish.

- Moving Averages: Price is under the 20- and 50-day EMAs. Short-term trend: down and not shy about it.

Directional lean

Bearish-neutral. BTC could give us a sympathy bounce into $98k–$99k, but until buyers win back $100k with conviction, sellers are the ones driving this bus.

Ethereum (ETH)

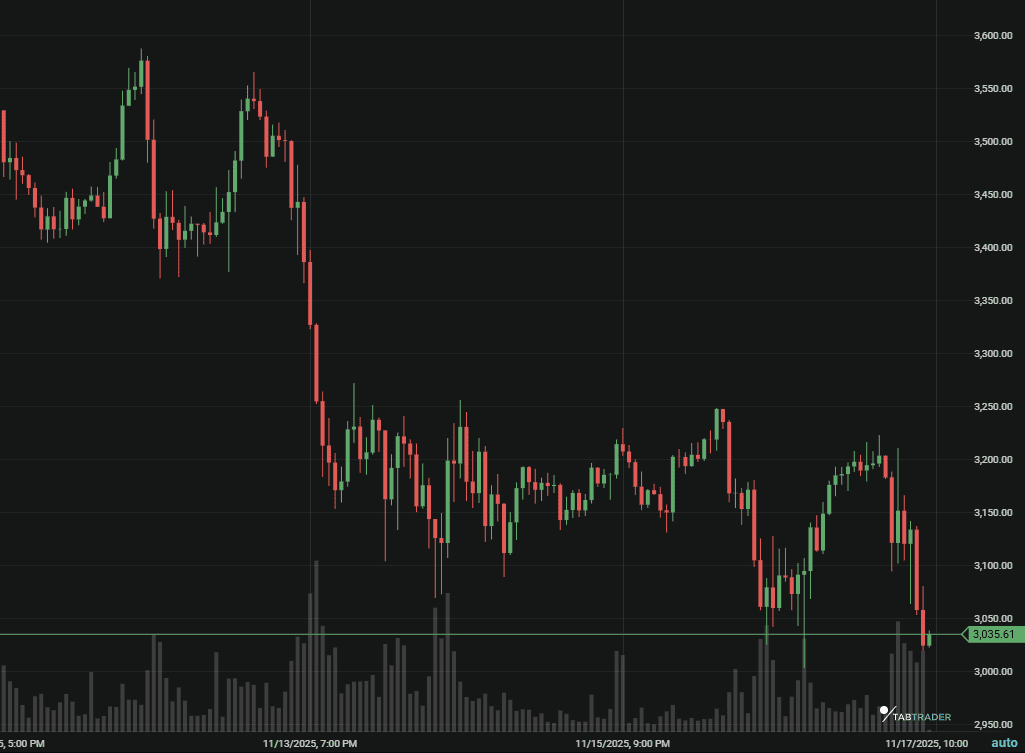

ETH is still struggling to outperform Bitcoin. Its BTC pair looks tired, and spot price sits near $3,100.

Strength level

Weak. Even the excitement around the upcoming “Fusaka” upgrade isn’t helping it stand on its own feet.

Key levels

- Support: $3,050. Lose this, and $2,800 becomes very realistic.

- Resistance: $3,377 (near the 50-period SMA).

For now, ETH is basically a passenger in Bitcoin’s car. Not the week to play hero with leverage longs unless ETH gets back above $3,380.

Major Altcoin sector overview

Bottom line: DeFi remains the primary area where traders are parking capital, while Layer 1s and gaming continue to bleed.

| Sector | Tokens | Trend | Quick Take |

| Layer 1 | SOL, ADA, AVAX | Bearish | L1s are slipping. SOL is stuck near $140 without much fight. ADA sits around $0.50 but feels hollow because volume’s missing. Most L1s are losing ground to BTC. |

| DeFi | UNI, AAVE, MKR | Slightly bullish | DeFi is quietly holding its own. UNI keeps printing surprise upside bursts, and AAVE is grabbing attention from anyone hunting yield while everything else goes sideways. |

| Gaming/Metaverse | SAND, AXS, MANA | MANA Bearish | Retail energy is gone, and gaming tokens rely on hype more than anything. SAND ($0.28) and AXS continue drifting lower despite the AI-integration headlines. |

Bottom line: DeFi remains the primary area where traders are parking capital, while Layer 1s and gaming continue to bleed.

Sentiment indicators

- Fear & Greed Index: 14(Extreme fear). It's bleak, but historically, this is the kind of mood where local bottoms start forming. Cue the contrarians rubbing their hands together.

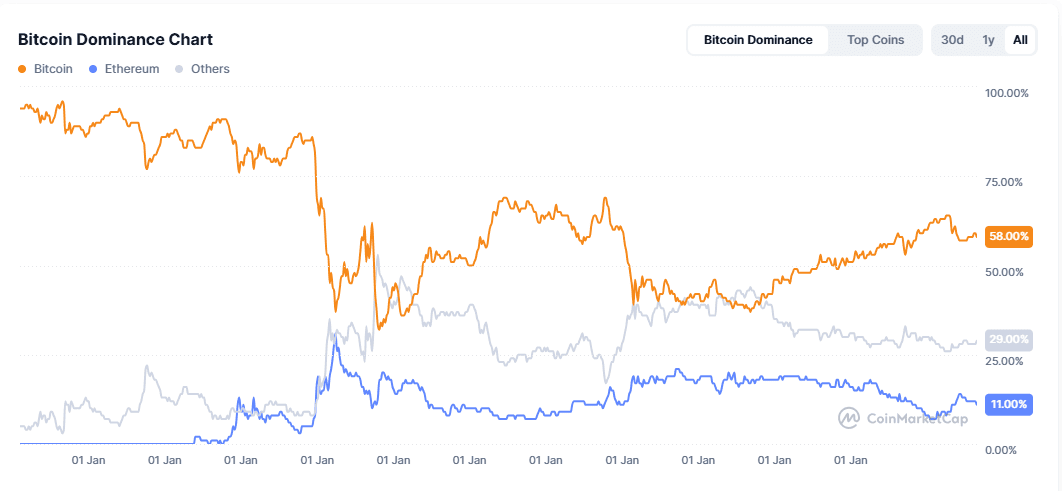

- BTC Dominance: ~58.7%. Moving higher as altcoins bleed faster. Definitely not altcoin season.

<b><i>Source:</i></b> CMC

Key events to watch this week

- Wednesday: Nvidia earnings. If Big Tech sneezes, crypto might catch the flu.

- Thursday: U.S. Flash PMI data release. This will be a quick read on economic cooling.

- All week: Markets digesting the Fed’s “hawkish pause” messaging.

Crypto scenarios to expect this week

Bearish

BTC fails to retake $98k, gets slapped down, and drifts into the $90k test. A clean break there could send us briefly into the $85k zone.

Neutral / Choppy

BTC trades sideways between $94k and $98k. Altcoins keep bleeding, but slowly. Stablecoins collect dust but stay popular.

Bullish

Some surprising good news, like a soft PMI print, gives BTC the shove it needs to reclaim $100k on strong volume. That could fuel a fast squeeze toward $106k.

Bottom line

The takeaway this week is simple: protect your capital. Fear is high, liquidity is thin, and Bitcoin is stuck under the level everyone cares about. If Nvidia’s earnings disappoint on Wednesday, the whole market might take another step down.

Stick with tokens showing relative strength (mainly DeFi), and avoid forcing trades in weak sectors. Cash isn’t cowardly; sometimes it’s strategy.

Want to learn more about technical analysis? Start here:

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.