Keltner Channels

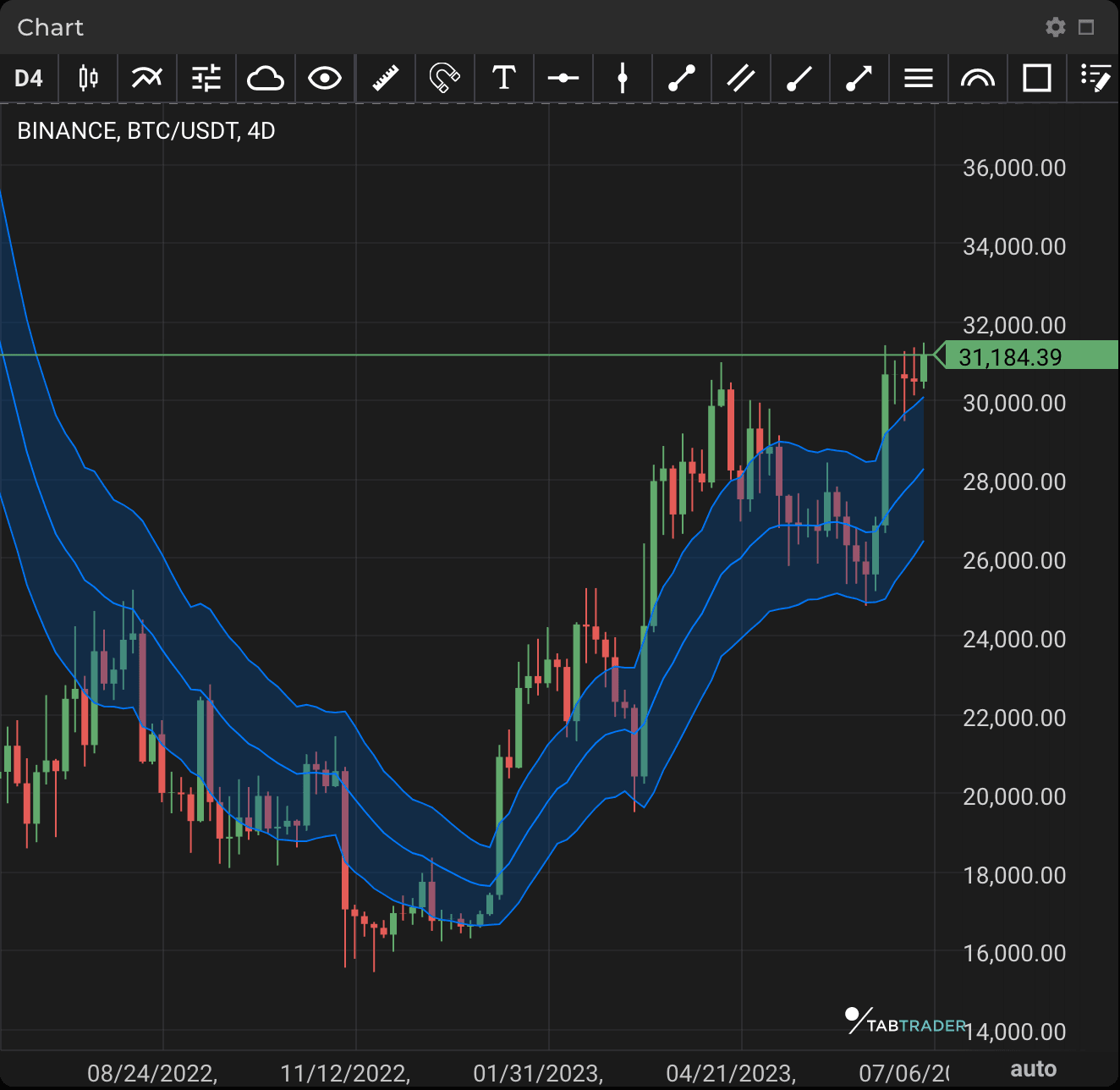

Keltner Channels (KC) are volatility-based bands that are placed on either side of an asset's price and can aid in determining the direction of a trend.

KC uses the average true range (ATR) for volatility, with breaks above or below the top and bottom barriers signaling continuation.

The upper and lower bands are typically set at two times the ATR above and below the exponential moving average (EMA), although the multiplier can also be adjusted based on personal preference.

Price reaching the upper KC band is bullish, while reaching the lower band is bearish.

The KC angle also aids in identifying trend direction. Price may also oscillate between the upper and lower KC bands, which can be interpreted as resistance and support levels respectively.

KC

Calculation

KC Middle Line = EMA

KC Upper Band = EMA+2∗ATR

KC Lower Band = EMA−2∗ATR

Where:

EMA = Exponential moving average (typically over 20 periods)

ATR = Average True Range (typically over 10 or 20 periods)