Updated November 10.

Key takeaways

- Macro uncertainty is running the show, with the US government shutdown and global data releases driving a risk-off attitude.

- Bitcoin is sitting right on the $100K support, and how it reacts here will likely set the tone for the rest of the week.

- Altcoins continue to bleed as capital rotates into Bitcoin, reflecting a defensive stance from traders.

Market overview

What’s the mood across crypto markets this week? Pretty cautious with fear looming large. The kind of “risk-off” energy that makes traders double-check their stop losses.

Here’s what’s driving it:

- The U.S. government shutdown is dragging on, which means key reports like CPI are on hold. That lack of data is feeding uncertainty and pushing traders toward safety. The U.S. Dollar Index (DXY) is catching a bid, and a stronger dollar usually spells trouble for risk assets like crypto and stocks.

- The Nasdaq experienced a sharp pullback last week, its worst since April 2025, as investors rethink high AI and tech valuations. That nervous energy is bleeding into crypto, with traders pulling back exposure to anything volatile

- Crypto liquidity has tightened sharply in recent weeks. Altcoins are getting hammered, with many down 15–30 % from October highs.” Until there’s clarity on the shutdown or new Fed guidance, the market’s basically in “pause and protect” mode. Bitcoin is up $106,000 on Monday, fueled by optimism over the Senate’s shutdown deal, short squeezes after last week’s leverage flush, and renewed institutional dip-buying.

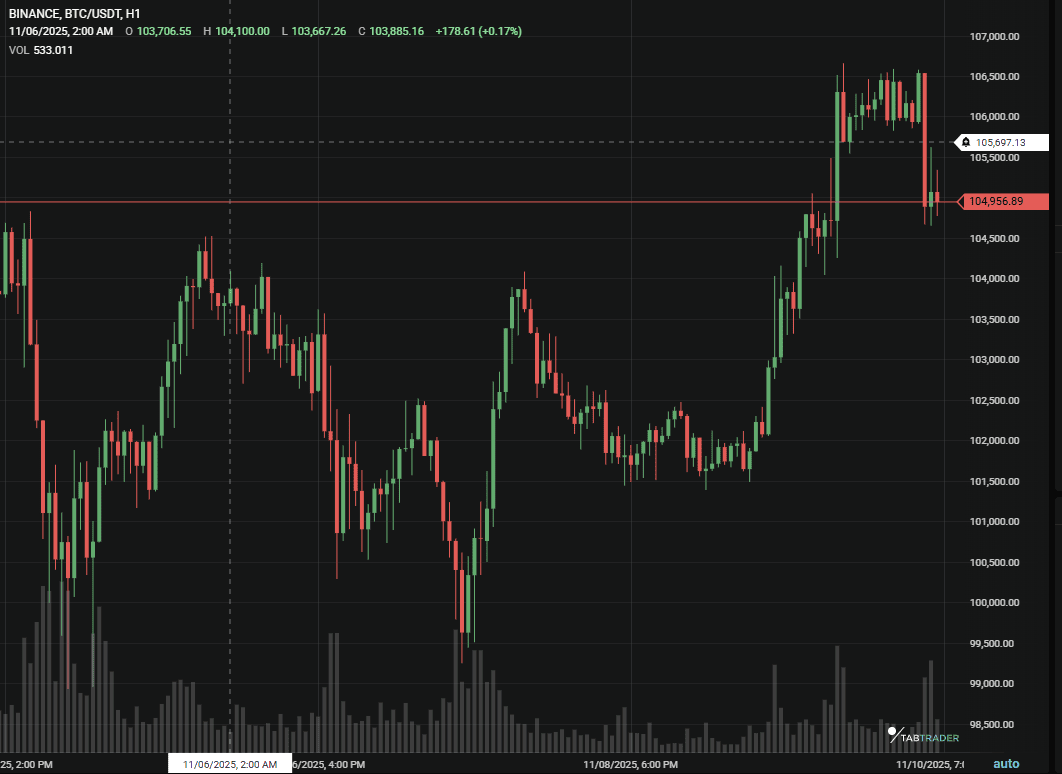

Bitcoin (BTC) analysis

Bitcoin’s lost its short-term footing and is now testing a huge psychological zone. After peaking near $126K in October, BTC’s been sliding fast. It broke below $106K last week, which is now confirmed resistance, and wrapped up around $101,725.

It’s both psychological and technical support. Lose it, and we could see a quick drop toward $93K.

If the market is bullish this coming week as it appears on Monday following the cooling of political temperatures in the US, the first stop would be reclaiming $106K. Then $117K becomes the next major test.

There’s also a broader context to consider. Alex Thorn, Galaxy’s Head of Research, has suggested that BTC’s upside this cycle may be more measured, potentially topping closer to $120K a revision from an earlier $185k estimate. Perhaps, more poignant, he adds that “Bitcoin has entered a new maturity era, and the days of 1,000x, 100x, or even possibly 10x gains are over.”

So while there’s still room for growth, the trend may be shifting into a more mature phase.

Indicators

- RSI: Showing a small positive divergence, price is lower, RSI isn’t, which might hint at a bounce.

- MACD: Still bearish; momentum favors the downside.

- Moving Averages: BTC is sitting below its 200-day MA, which keeps the bigger picture bearish.

- Short-Term Bias: Still bearish until proven otherwise. If $100K doesn’t hold, brace for some volatility.

Possible scenarios for BTC this coming week

- Bearish: BTC breaks $100K, closes below it, and selling accelerates toward $93K.

- Neutral / Range: BTC chops between $100K–$106K, consolidating while traders wait for macro news.

- Bullish: $100K holds, volume returns, and BTC reclaims $106K, trapping shorts and setting up a push to $117K.

Ethereum (ETH) snapshot

Ethereum’s also feeling the pressure, but hasn’t cracked as badly as Bitcoin.

ETH/USD

- ETH vs. BTC: The ETH/BTC pair keeps slipping, meaning ETH is underperforming, pretty normal when traders go defensive.

- Current Zone: ETH is hovering around $3,500, after a brief scare below $3,000 last week.

- Support: Watch $3,300 first, then $3,000 as the big one.

- Resistance: Needs to push past $3,575–$3,700 to show real strength.

To summarize, ETH’s alive, but it’s not leading.

Major Altcoin sector overview

Altcoins are taking the brunt of the selloff as traders rotate back to “safer” bets.

| Sector | Tokens | Trend | Quick Take |

|---|---|---|---|

| Layer 1 | SOL, AVAX, ADA | Neutral | Mixed bag. Solana’s holding up surprisingly well thanks to ETF inflows, while others are just drifting. |

| DeFi | AAVE, UNI, MKR | Neutral / Mixed | Builder activity continues but price traction is limited. |

| Gaming / Metaverse | AXS, SAND, MANA | Bearish | One of the weakest sectors. The hype’s long gone, and with risk appetite low, these are getting hammered. |

In summary, the altcoin market is experiencing a significant drain of capital. This is the trend we see this week. It’s the usual rotation: money moves from speculative sectors, into Layer 1s, then piles into Bitcoin. From our analysis, it is the classic risk-off flow.

Sentiment indicators

- BTC Dominance: Sitting around 59.2% and climbing. Traders are parking funds in Bitcoin, ditching alts. That’s your textbook risk-off signal inside crypto.

- Fear & Greed Index: Down to 29 (“Fear”), a big mood swing from the “Greed” levels earlier. People are nervous again, and sometimes, that’s where opportunity hides (eventually).

Image source: CMC

Key events to watch this week

With US data delayed, the market will be watching international data and central bank speakers:

- Ongoing: Any news or potential resolution regarding the US government shutdown. A resolution could be a bullish (risk-on) catalyst. Follow live updates here.

- Tuesday, Nov 11: ECB President Lagarde speaks.

- Wednesday, Nov 12: UK GDP and labor market data.

- Thursday, Nov 13: China Industrial Production and Retail Sales.

Bottom line

This week, macroeconomic factors run the show. Crypto’s clearly in defense mode, and Bitcoin’s $100K line is the one chart level that matters most. Break it, and we likely see another leg lower. Hold it, and we might finally get that relief bounce traders are hoping for.

Either way, this is a week to stay patient, protect capital, and avoid hero trades. You don’t want to be the one trying to catch a falling knife, or worse, catching it by the blade.

Want to learn more about technical analysis? Start here:

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.