Crypto Market Weekly Outlook: Fed Decision Looms as BTC and ETH Hit Critical Levels( December 8-14, 2025)

Key takeaways

- Bitcoin remains range-bound between $86k-$96.5k ahead of Thursday's FOMC decision.

- Key technical levels: $96,500 resistance (breakout zone), $86,000 support (breakdown risk)

- Institutional flows have turned positive after weeks of outflows, signaling renewed interest as traders position ahead of the Fed.

Market overview

This week, crypto markets are likely to move sideways ahead of Thursday’s FOMC decision. Monday saw modest gains with a total market cap at $3.24T as traders wait for clarity.

Recent US data has leaned slightly dovish. Softer jobs data and inflation landing roughly in line have pushed expectations toward a 25-basis-point cut. Despite that, the mood across risk assets stays defensive. The December 2025 US jobs report is due Friday, January 9, 2026. That means, as of Monday, December 8, the latest hard data still reflects November’s labor market.

ADP showed 32,000 private-sector job losses in November, the weakest print since March 2023, largely coming from small business pullbacks. At the same time, continuing claims dropped to 1.94 million, the lowest level in seven weeks. Hiring has slowed, but firing hasn’t accelerated. It’s a sluggish, stable labor market, not a collapsing one. That backdrop still leaves the broader 2026 outlook intact for now.

For crypto, the setup is contradictory. Easing policy expectations should help in theory. In practice, liquidity is thin and leverage is elevated. That makes price action twitchy, with even small shifts in macro expectations getting amplified.

Crypto outlook this week

This week’s outlook is neutral with a volatility spike expected mid-week, driven primarily by the Federal Reserve’s final policy decision of 2025.

- Directional bias: Neutral until the Fed speaks. Bitcoin and Ethereum remain trapped in tight ranges. Markets are unlikely to commit to a trend before Thursday. Expect muted moves until the FOMC outcome.

- Volatility trigger: A 25 bps rate cut is widely anticipated. What isn’t priced in is Powell’s guidance for 2026. A hawkish tone could drive prices lower, while a clearly dovish tone could spark a potential breakout.

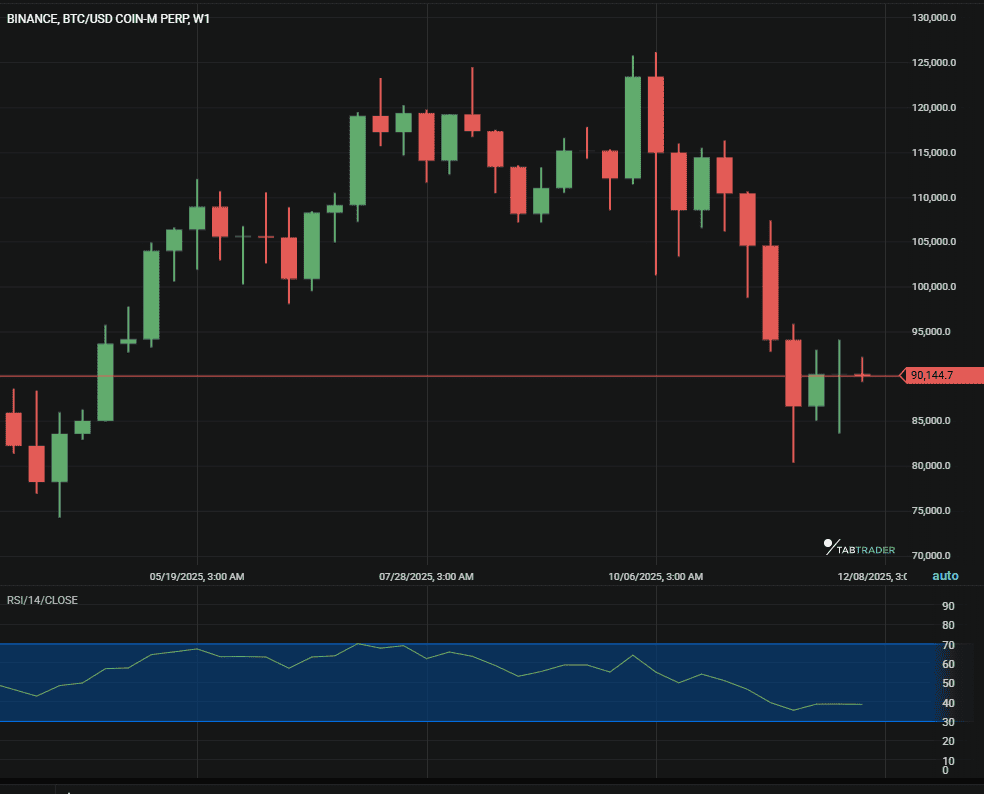

Bitcoin (BTC) analysis

Bitcoin has cooled off after the October run and is now chopping sideways. The market is stuck between two opposing forces: a short-term rising channel and a broader downtrend pressing from above.

BTC/USDT

The structure leans neutral-to-soft while price stays pinned under the $92,000–$95,000 zone. That area has acted like a ceiling, and price hasn’t done much to challenge it yet.

Key levels

- Support: $88,000–$86,000 first, then $84,000–$82,000. A loss of these zones opens the door toward $80,000.

- Resistance: $96,500 sits at the junction of channel resistance and the larger bearish trendline. A decisive push through that level would change the technical picture in a meaningful way.

No directional edge exists until $96.5k breaks or $86k fails. Volume isn't confirming either side. The market is waiting for a macro trigger from the Fed.

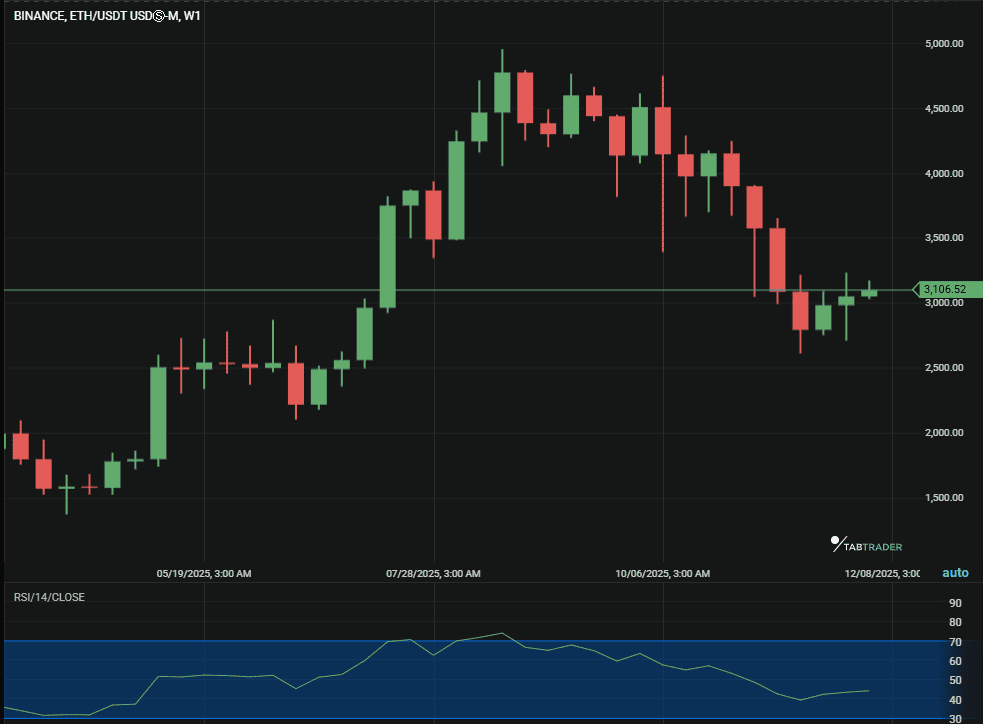

Ethereum (ETH) snapshot

Ethereum is moving in the same lane as Bitcoin. It’s holding a short-term bounce structure, but that sits inside a broader downtrend, so the bigger picture hasn’t flipped.

ETH/USD

Key levels

Against BTC, ETH looks steady but not convincing. It’s defended important areas, but there’s no clear sign of leadership or independent strength yet.

- Resistance: $3,200 is the line in the sand. A clean break above it puts $3,620 in play.

- Support: If price slips below the rising channel, the market likely revisits the $2,630 zone.

Major Altcoin sector overview

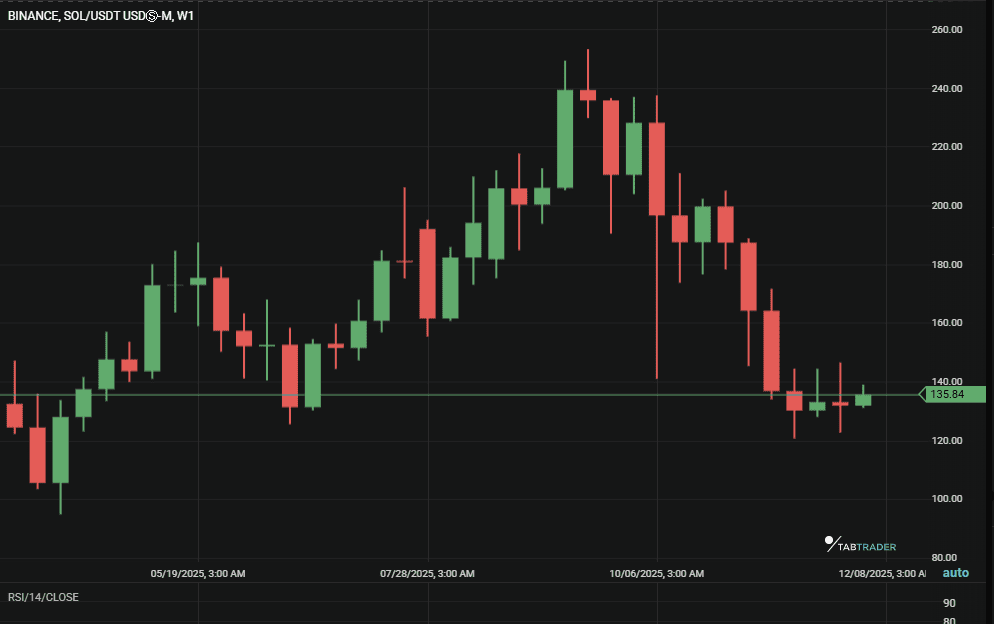

Layer 1s such as SOL, ADA, and AVAX remain neutral and range-bound.

Solana (SOL) is the clearest example of the indecision in this sector, with price trapped between strong support at $120 and resistance at $145. Until one of these levels breaks, the sector is likely to remain in a holding pattern.

SOL/USDT

DeFi tokens including UNI, MKR, and AAVE are showing a neutral to bearish trend.

There is no strong catalyst driving these assets, and their performance continues to mirror broader Ethereum movement and general market sentiment. Without independent momentum, upside remains limited for now.

The Gaming sector represented by tokens like SAND and MANA leans bearish.

Both are trading near the crucial $2.00 support area. If this level breaks, the sector risks a deeper correction, potentially pulling prices down toward the $1.63 region.

According to our analysis as of December 8th, 2025, no sector is decisively outperforming the other. Layer 1s are range-bound, while more speculative sectors like Gaming lag. The market is awaiting a macro-driven signal for a unified directional move. We expect more decisive movements once the Fed makes a decision on interest rates.

Market metrics and sentiment

BTC dominance

Bitcoin dominance has slipped 1.5 percentage points over the past month. Capital is rotating into alts. It doesn’t scream euphoria, but it does suggest the worst of the fear has cooled off.

Institutional flows (ETPs)

November saw heavy outflows. Last week flipped the script, with roughly $900 million moving back into crypto ETPs. Institutions are reacting quickly to shifting Fed expectations rather than taking a long-term stand.

Whale activity

Holders with 100k+ BTC have sold around $12.3 billion over the last month. That supply hasn’t hit the market all at once. Mid-sized whales (10k–100k BTC) have been absorbing it. This looks more like reshuffling than outright panic, alternatively, this likely signals seasonal tax-loss harvesting rather than fundamental panic.

Key events to watch this week

- Fed rate decision (Dec.9-10): This is the main event. The market will care less about the cut itself and more about Powell’s tone and how 2026 is framed.

- China inflation data (Dec. 10): Gives a read on whether deflation pressures are sticking around in a major part of the global economy.

- Corporate earnings (Dec 9-13): Oracle and Broadcom earning reports will be read for signs of how healthy tech spending and the AI build-out actually are.

Possible scenarios for the upcoming week

- Bearish case: A hawkish Fed surprise or a break below $86,000 on BTC would likely confirm the larger downtrend. That opens the path toward $80,000 and usually drags altcoins down with it.

- Range-bound case: The Fed cuts but stays vague. Price chops inside existing ranges. BTC sits between $86k–$95k, SOL between $120–$145. Expect messy, low-conviction price action.

- Bullish case: The Fed leans clearly dovish and BTC breaks and holds above $96,500. That would be the first real signal the downtrend is easing. This setup would likely draw institutional flows back in and put $100k–$105k back on the radar. Large-cap Layer 1s would probably move first.

Bottom line

This week is about tone, not the cut itself. The market already expects the move. What isn’t priced in is how the Fed talks about 2026.

Risk management matters more than prediction here. Watch $96.5k and $86k, the market's next move starts at one of those lines. Trade the break, not the range.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.