How Does the Spot Market Work? Types of Spot Markets

What is the Spot Market?

The definition of a spot market is simple: in spot trading, financial assets (crypto, commodities, currencies, stocks, etc.) are exchanged with immediate delivery. Spot market is often contrasted with the futures market, which in turn allows traders to swap value on a particular date in the future.

Understanding Spot Markets

It really is as easy as it sounds. On the spot market traders exchange assets as quickly as possible at the current available market price. As opposed to limit orders that execute trades at the time the asset reaches a specific valuation, market orders are carried out immediately as the buyer and the seller agree on the price.

Even though the money and the trading instrument can take up to two days to be delivered, the key part is that parties agree on the price right away. In today's age of digitalization and modern finance, delivery can transpire almost immediately.

Spot Markets are also frequently referred to as “physical markets” or “cash markets”* as their trades entail an instantaneous exchange of value between the parties.

Characteristics of Spot Markets

- Every transaction is settled at the current price known as the spot price / spot rate

- The traded asset is delivered immediately or at least within 2 business days for Forex and Stock markets, and seven days for commodities. Cryptoassets are delivered as soon as the transaction is processed by the operating blockchain

- The funds are also usually transferred instantly or at least within 2 business days of the purchase date

- Spot trades are typical for exchanges and Over-the-Counter (OTC) markets

- Spot markets are opposed to derivatives markets, where forwards, futures, and options contracts are traded

Trading Mechanism

On Spot Markets a transaction is effected when buyers and sellers orders are matched. On the quote-driven markets asset liquidity is maintained by designated market makers while the order-driven markets post all the available bids and asks.

Spot Price

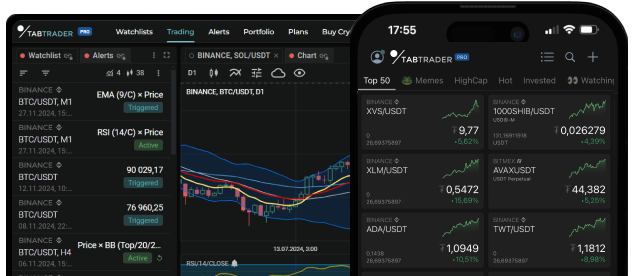

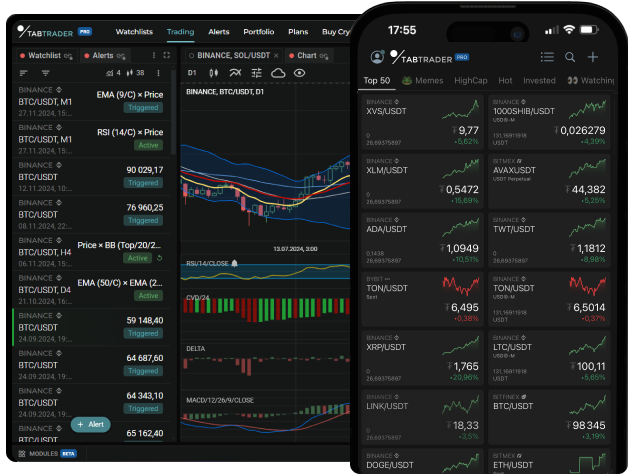

Spot Price or Spot Rate refers to the current price of the financial asset. This is the price for which traders can buy or sell an asset immediately. The term “spot price” originates from a phrase “on the spot” and refers to the instantaneousness of spot market transactions. In liquid and volatile markets, such as crypto markets, asset prices may vary by the second as the existing orders are being completed and the new ones enter the market. The TabTrader app allows users to track price changes for more than 6 000 cryptocurrencies in real time. Spot price is often contrasted with forward or futures price. While spot prices refer to the cost of a security for immediate payment and delivery, forward prices determine the asset cost as a function of time that depends on parameters such as, for example, time value of money (TVM), yield curve, and/or storage costs.

with TabTrader

Types of Spot Market

There are normally two distinct types of spot market: Over-the-Counter (OTC) markets and organized market exchanges. Let’s take a closer look at each of them.

Spot Market and Exchanges

An exchange is a centrally managed platform that allows buyers and sellers to connect with each other in order to make a trade. While electronic exchanges offer increased trading efficiency and instant price updates, traditional trading floors provide a centralized physical location for deals to be performed. Among thousands of digital crypto exchanges only the top 10 generate the majority of the trading volume and have a real impact on rates of virtual assets in the current market. You can view all these exchanges in the TabTrader app. Some exchanges deal with a wide variety of currencies, stocks, commodities, crypto and other assets. Other exchanges prefer to pick a particular niche. Trading is conventionally carried out with the help of brokers (except crypto markets) who can act as market makers.

Spot Market and Over-the-Counter

Over-the-Counter (OTC) Markets trade assets through a distributed broker-dealer network. They relish the true essence of the spot market and similar to a lot of centrally controlled exchanges and allow traders to handle the negotiations "on the spot". OTC Markets are not regulated by a central authority and conclude trades without imposing restrictions on price, asset quantity and other transaction terms. As most of the trading orders on the OTC market are filled in private, this type of market offers a personalized service as opposed to seller anonymity in large corporations. While centralized exchange’s central supervision strategy has the potential to ensure market liquidity and protect investors from possible risks, OTC market’s regulation-free approach offers low-cost processing and access to securities otherwise not available on the formal market.

| Characteristics | Exchanges | OTC Markets |

|---|---|---|

| Supervisors | ||

| Trading is done in private | ||

| Has trading asset standards (quantity etc.) | ||

| Limited number of assets |

Example of a Spot Market

Pros and Cons of Spot Markets

Spot Markets have certain advantages attracting millions of traders worldwide:

- Spot markets are well-known for a transparent environment: there is no hidden catch; everything can be seen and agreed upon right away

- The execution of spot contracts requires less technical effort than, for instance, realization of futures contracts

- Spot Market allows traders to more easily find a suitable price in a volatile market

- As Spot Market purchases are obtained by the buyers immediately upon agreement, they retain less chance of delivery failure

- Spot market sets no minimum contract requirements

However:

- Spot markets are known to demand higher prices for the flexibility they offer

- Spot markets are far less flexible in terms of timing, as parties are normally expected to perform the asset delivery immediately

- Spot market traders may fall victim to inflation and be forced to buy assets for more than the average price at a certain point in time

- Spot market transactions can be potentially harder to regulate, as the asset delivery is concluded instantly

Spot Market FAQs

Here you can find answers to the most frequently asked questions. If something is still unclear, don’t hesitate to tell us!

What is a spot trade?

A spot trade is an exchange of assets that takes place immediately upon agreement.

What is an example of a spot market?

The New York Stock Exchange (NYSE) is a centralized stock exchange where traders purchase and sell securities for instant delivery.

What is spot trading?

Spot Trading is a process of buying and selling of value for an immediate settlement at a current rate.

How do spot markets work?

Spot market traders post sale or acquisition orders on a variety of assets (e.g.,cryptocurrencies, fiat currencies, commodities), which are then matched by a broker or an exchange.

What is a spot price?

The spot price is the current cost of a particular asset for instant acquisition and settlement. Spot prices depend on supply and demand changes and are prone to volatility.

What is the difference between the spot market and the forward market?

While on the spot markets, trading instruments such as cryptocurrencies, forex, stocks, or bonds are exchanged for cash with immediate delivery, forward markets trade futures contracts, which involve settlement at a later date.

What is the difference between the spot market and the futures market?

Futures market allows traders to buy and sell commodity and futures contracts for a delivery at a predetermined date in the future. Spot market implies immediate settlement and instant exchange of assets.