Leverage Trading Explained

Leverage trading is a method of trading financial instruments such as stocks, Forex and cryptocurrencies which increases exposure to an asset without the need for extra capital.

What is Leveraged Trading?

The simplest form of trading financial assets involves direct exposure which equals the amount of capital put forward by the trader.

For example, a trader has 1,000 units of currency A and uses all of them to gain exposure to currency B at a specific rate. The rate then goes up or down, but the initial exposure is fixed by the rate that the trader agrees to at the time.

In leverage trading, traders can access more of currency B than their amount of currency A can technically purchase.

This allows them to control a larger position in the asset without having to find the equivalent capital themselves. The amount of “extra” exposure varies according to the leverage ratio — in general, exchanges offer 1:10, 1:20, 1:50 and 1:100, but other ratios can also appear.

As an example, a $100 investment at the higher 1:100 ratio would mean that a trader would control a $10,000 position.

Note that due to the inherent risks involved with using leverage, in some circumstances, restrictions apply on who can use it and to what extent. In the United States, for example, traders are limited to a maximum leverage ratio of 1:50.

For the same reason, given the volatility widespread on cryptocurrency markets in particular, major exchanges commonly limit the leverage ratio available to new users. Binance, for example, allows a maximum 1:20 leverage for accounts active for 60 days or less.

What is Margin in Leverage Trading?

Margin is a way for traders and exchanges to reduce risk when trading with leverage. It is standard practice to trade on margin, as it reduces the amount of capital a trader requires to use leverage while allowing more room for volatility without liquidating their capital.

Margin is how much a trader needs to invest in a position, and leverage is the multiple of the investment as it trades as a position on the exchange.

In cryptocurrency margin trading, exchanges tend to segregate margin wallets. Funds are transferred from the trading wallet and used as collateral for borrowing more.

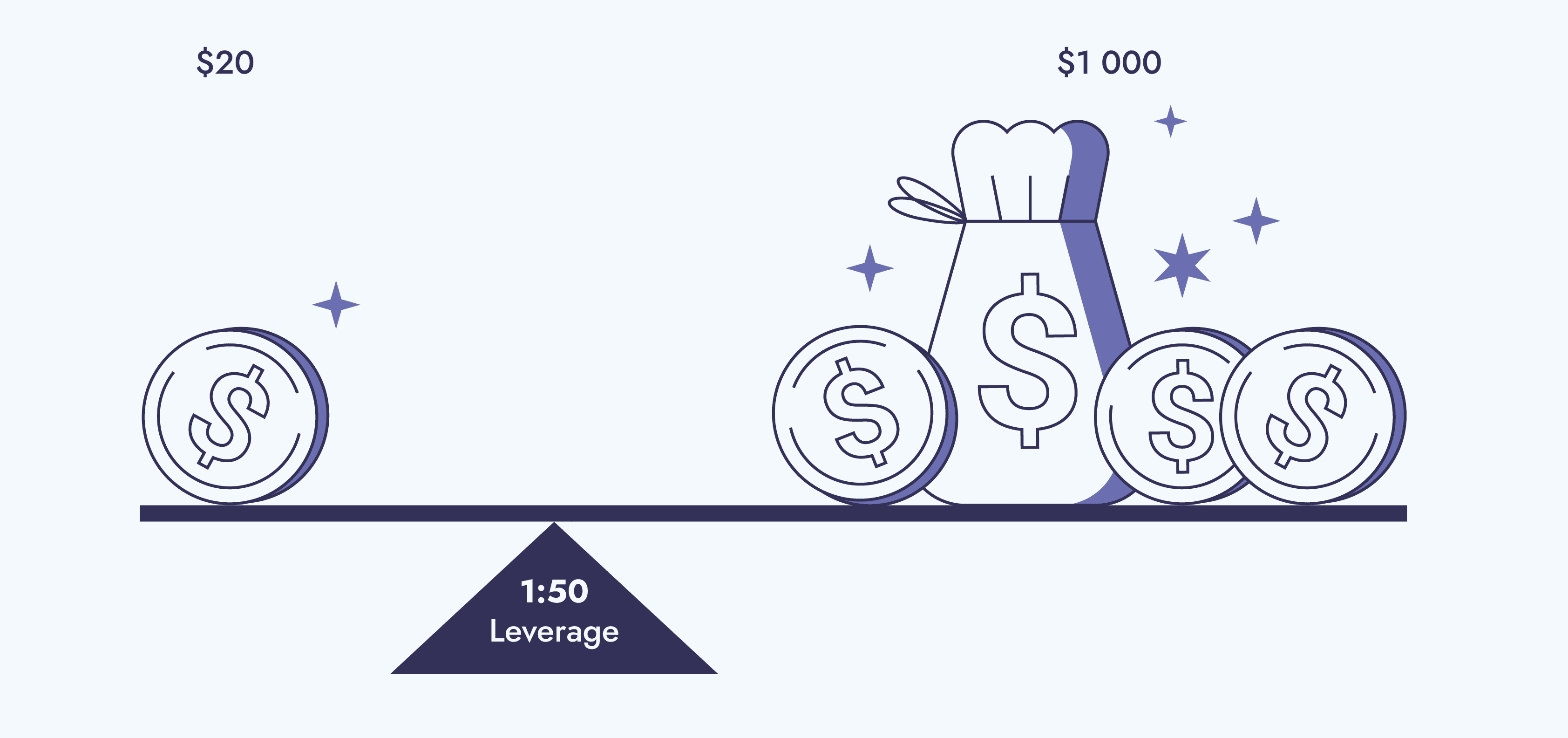

The margin is the sum total put forward by a trader in order to open a leveraged position. For example, a $1,000 position at a leverage ratio of 1:50 implies a 2% margin — $20.

When closing the position, the trader will need to pay back the borrowed funds plus interest — in this case $1,000 plus interest — whatever has happened to the market in the meantime.

Given that cryptocurrency markets can encounter sudden and significant volatility, exchanges provide a real-time margin level reading so that traders know in advance if volatility is about to liquidate their position.

They then either add more funds to their margin wallet to avoid the exchange automatically selling their entire margin balance in order to repay the funds borrowed on margin.

Pros and Cons of Leverage Trading

The Pros of Leverage Trading

- Leverage allows traders to control a much larger position in an asset than they could otherwise afford based on the investment capital they have.

- If the trade is successful, leverage creates outsized returns relative to the initial capital invested. Again, such returns would not be possible with a simple trading strategy which does not use leverage.

- If used correctly with appropriate tools to control risk (notably effective use of margin), leverage trading can be relatively safe for experienced traders.

The Cons of Leverage Trading

- As its name suggests, leverage trading carries orders of magnitude higher risk than basic trading. This risk manifests itself in various ways.

- If an asset goes in the opposite way to a trader’s bet, they can lose much more money than the capital they own.

- How much an asset can go the “wrong” way without liquidating the trader’s funds depends on the parameters of each individual leverage trade..

- If a trader uses leverage in combination with a risky trading strategy, for example on a volatile asset without using stop-loss of take-profit orders, the risk of major losses increases even more..

- Inexperienced traders can easily erase their starting capital, or even their entire exchange account (also called “blowing” an account), by failing to set up trades correctly if those trades are leveraged. Again, this is because leverage increases the potential returns and/ or losses from a trade.

Leverage Trading Example (Calculation)

A trader has €100 to spend on buying U.S. dollars. Let’s say that EUR/USD is currently trading at $1.10.

With €100, the trader would be able to buy a maximum of $110, but they want to do more with their capital.

They decide to enter into a 1:20 leverage trade using their €100, meaning that with the money they can enter a maximum position worth €2,000 or $2,200.

EUR/USD rises from $1.10 to $1.12 and the trader decides to take profit. Now, their position is worth up to $2,240.

The trader has thus used a €100 investment to generate a profit of $40 (approximately €35.71). Note that exchange fees and other costs associated with the trade will impact profitability.

When Should I Start to Use Leverage in Trading?

Leverage trading is not for beginners — even though many exchanges allow any verified user to experiment with it.

The reason for this is clear (and outlined in the Pros & Cons section above) — risk. In cryptocurrency especially, sudden volatility can upend a trading strategy in minutes or even seconds.

Add to that the often complex mathematics needed in order to understand how much risk each individual trade can withstand before getting liquidated and the need for experience and confidence becomes all the more obvious.

Nowadays, exchanges handle a lot of the process on behalf of traders, but this can be problematic in itself, as a more “hands off” approach can lead beginners to take on undue risk without appreciating the implications of getting the trade wrong.

To experiment with leverage trading, start small, choose a less volatile, highly liquid market (such as BTC/USDT) and always use margin. Be sure that you understand the mathematical structure of the trade and the potential outcomes — especially how much room for maneuver your trade has before liquidation occurs.

Lastly, even if you have experience in leverage trading on traditional markets such as Forex, be aware that cryptocurrency exchanges use processes which may be unfamiliar and require additional research prior to trading.

Leverage Trading FAQs

How does leverage trading work?

Leverage trading works by allowing traders greater exposure to an asset than their capital would otherwise allow — and increases the profit potential of their trade in the process.

What is one example of trading with leverage?

A trader has €100 to spend on trading. In a simple 1:10 leverage trade without margin, the trader uses this balance to gain €1,000 of exposure to their chosen asset, the U.S. dollar. At $1.10, the trader controls a position worth $1,100. EUR/USD increases to $1.15 and the €1,000 exposure is now equal to $1,150. The trader has made $50 out of an initial €100 investment if sold.

What does x20 leverage mean?

Leverage can be higher or lower depending on the risk appetite of the trader. It is commonly presented as a “leverage ratio”. 1:20, or x20, means that for every one unit of currency invested, the trader controls 20 units of currency in the leverage trade.

Is it good to trade with leverage?

If you have the experience and have calculated the risk involved, leverage trading can dramatically increase investment returns and enable larger profits in a much shorter period of time than with standard trading.