Crypto Chart of the Week: Bitcoin Reclaims $90K as Fear Persists

Bitcoin delivered a welcome reversal on Friday, pushing back above the critical $90,000 psychological level after testing lower supports earlier in the period. The reclaim sparked renewed optimism amid ongoing macro caution, with Ethereum showing signs of stabilization but still lagging in relative strength.

While volatility remains elevated, this week's action hints at potential exhaustion of sellers and early buyer conviction, though confirmation is needed for a sustained shift.

Key takeaway

- Bitcoin's successful defense of $88,000–$89,000 followed by a push above $90,000 marks a bullish development after recent pressure. As market participants noted during the recovery, "the reclaim of $90K could be the catalyst for short covering and fresh inflows."

Macro outlook

Lingering uncertainties from global policy shifts, tariff rhetoric, and liquidity dynamics kept risk assets choppy, yet Bitcoin's resilience stood out. Institutional positioning, including whale accumulation signals such as Strategy's Inc. recent acquisition of 22,305 Bitcoin for approximately $2.13 billion provided tailwinds during the dip, helping fuel the rebound.

Gold's strength persisted as a safe-haven play, but crypto showed selective bounce-back potential as sentiment edged toward neutral territory.

Crypto experienced sharp swings mid-week before late recoveries. Bitcoin dipped to lows near $87,200–$88,600 early in the week before climbing to highs around $90,300+, closing the period with a firm hold above $90,000.

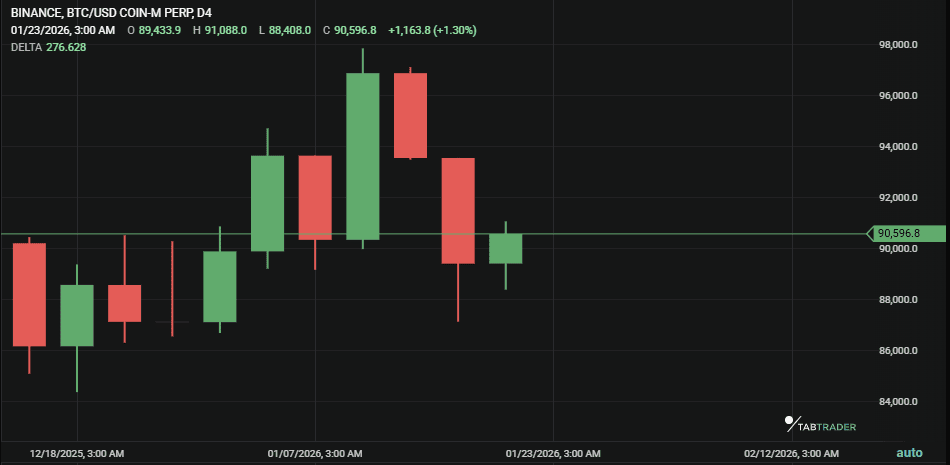

Bitcoin (BTC)

Bitcoin navigated a volatile week (January 19–23, 2026), starting higher near $93,000–$94,000, dipping sharply to test $87,200–$88,600 mid-period, then rebounding strongly to reclaim $90,000+ by Friday. The move flipped short-term structure bullish, breaking recent resistance and squeezing low-volatility setups.

- BTC remains corrective from prior peaks but this week's reclaim signals potential stabilization in the upper $80K–$90K range.

- Buyers overwhelmed sellers above $90,000, turning it from resistance into near-term support.

Key Bitcoin levels to watch

- Support: $89,000–$90,000 (former resistance now tested as floor)

- Downside risk: Reversal below could retest $88,000 or lower toward $87,000

- Bullish signal: The breakout above $90K shifts bias upward. If bulls can hold the price above $90,000 coupled with rising volumes, the immediate target is $93,000+

BTC/USDT

Track BTC price live on TabTrader chart.

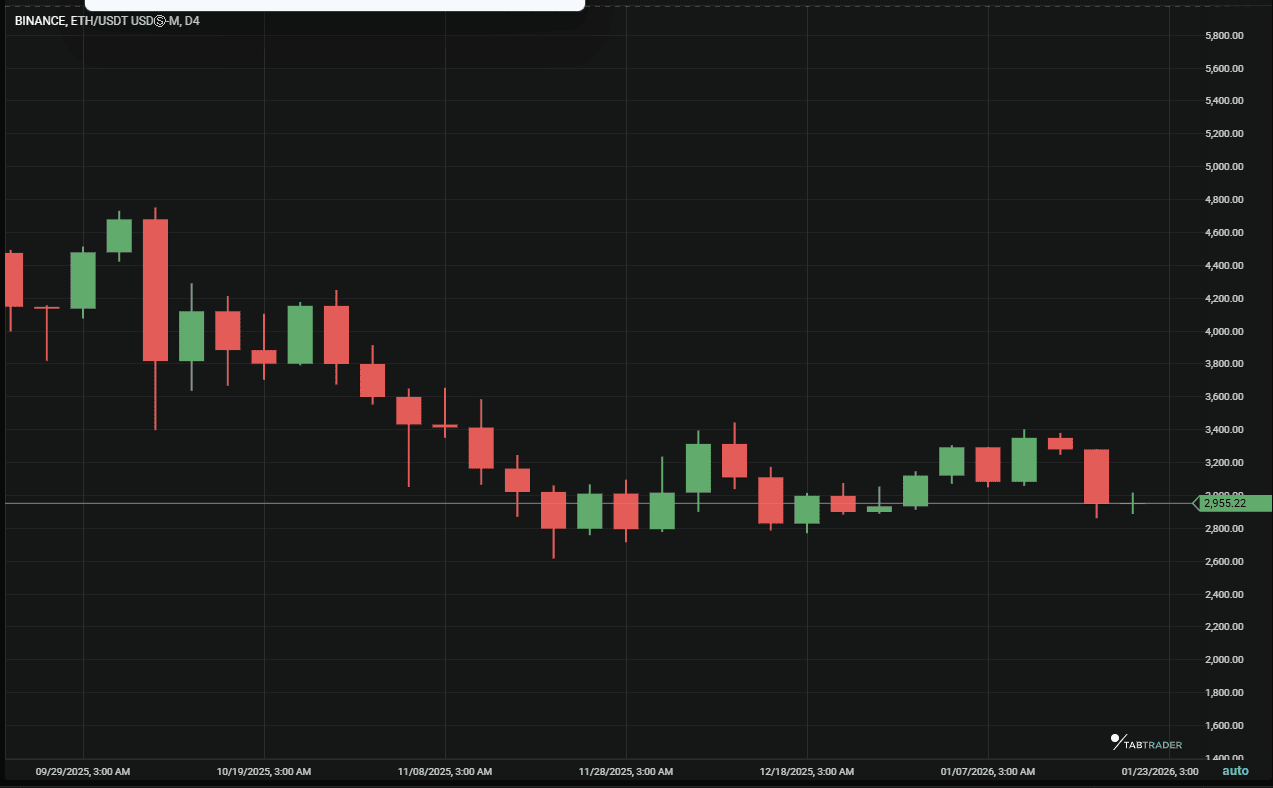

Ethereum (ETH)

Ethereum showed relative weakness but stabilized around $2,900–$2,970, with intraday dips below $2,900 before partial recovery. The ETH/BTC ratio remained soft, underscoring Bitcoin's dominance in the rebound.

- Structure leans toward basing below $3,000, with rallies meeting selling pressure.

- Altcoin sentiment stayed cautious, though ETH held key psychological levels.

Key Ethereum levels to watch (monitor in real-time via TabTrader):

- Support: $2,900–$2,950 (recent lows defended)

- Bullish trigger: Push above $3,000–$3,100 with strong volume for reversal confirmation

ETH needs conviction to catch up, deeper tests remain possible without BTC-led strength.

ETH/USDT

Crypto market sentiment

The Crypto Fear & Greed Index hovered in Fear territory earlier but edged toward Neutral (around 34) by week's end, reflecting easing caution as Bitcoin reclaimed ground. Such shifts often precede stabilization when fear exhausts and buyers step in, though macro risks could cap exuberance.

Bottom line

Bitcoin's reclaim of $90,000 stands out as the week's defining move, turning consolidation into early bullish momentum while Ethereum lags but holds support. Whale support and reduced selling pressure offer underlying strength, yet broader risk appetite stays measured. Focus on Bitcoin's hold above $90,000 and any volume-backed extension higher for trend confirmation.

Until then, prioritize disciplined entries, tight stops, and capital preservation, use TabTrader's live crypto charts, and turn on the notifications to scan these levels in real time and position with confidence.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.