Key takeaways

- Capital is still rotating internally, alts into BTC, BTC into stables, while fresh money remains largely absent due to holiday liquidity

- Price action remains choppy and range-bound, amplified by low liquidity rather than fundamental shifts.

- Bitcoin consolidates in repair mode below $90,000, showing brief spikes but quick reversals.

- ETH/BTC ratio lingers near multi-year lows, underscoring ongoing institutional tilt toward Bitcoin over alts.

Market overview

Crypto heads into the final days of 2025 with participation near seasonal lows. Bitcoin briefly spiked above $90,000 on December 29 amid thin Asian trading but reversed gains, settling around $87,000–$88,000. Overall, Q4 price performance marked Bitcoin’s weakest fourth quarter since 2018.

Macro backdrop remains mixed: recent Core PCE data (released December 23) showed inflation cooling slightly, but labor softening keeps the Fed in a cautious stance. Odds of a rate cut in early 2026 have moderated, contributing to subdued risk appetite. Capital flows stay defensive, alts into BTC, then into stables, with no signs of broad inflows or outflows.

Low liquidity continues to dominate behavior. Sharp spikes are possible, but follow-through is rare. Until volume returns in January, sustained trends are unlikely.

Bitcoin (BTC) analysis

Bitcoin ends the year in consolidation after failing to sustain above $90,000. Brief pumps to $90,300 evaporated quickly, highlighting fragile structure in low-volume conditions.

Key levels

Price compresses around $87,000–$88,000, with $90,000 acting as firm resistance. The monthly chart's key support remains $85,000; a decisive break could open $75,000–$80,000. Upside requires a clean reclaim of $92,000 for renewed momentum.

BTC/USDT

Technical indicators

Momentum is neutral. Daily RSI hovers near 50 with no meaningful divergence. The 50-day EMA continues to cap price. In thin holiday markets, “Bart” patterns—fast spikes followed by quick fades—remain a clear risk.

Near-term bias: neutral to mildly bearish. Expect uneven, frustrating trade within the $85,000–$90,000 range.

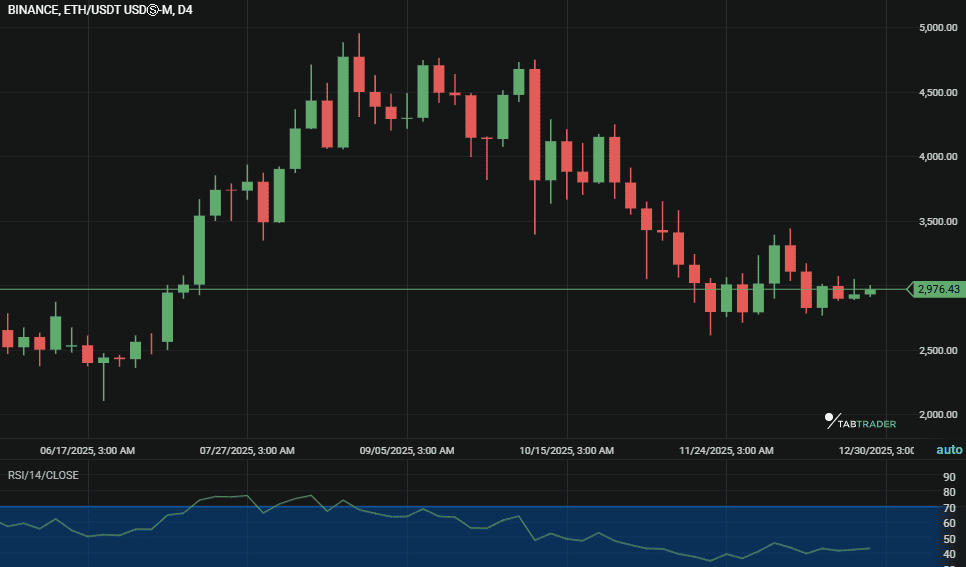

Ethereum (ETH)

Ethereum lags further, trading sub-$3,000 (around $2,950–$2,980). Relative weakness persists, behaving as a high-beta play on BTC with asymmetric downside. ETH/BTC near multi-year lows reinforces Bitcoin dominance.

ETH/USDT

Key levels

$3,000–$3,150 overhead resistance; downside watches $2,800, with risk to $2,500 on a clean break.

Major Altcoin sector overview

- Layer 1 altcoins: Continued bleed vs. BTC; SOL holds relatively better but lacks independent drivers.

- DeFi: UNI remains a standout after the fee switch activation and treasury burn (~100M UNI), providing idiosyncratic support amid broader chop.

- Gaming/Metaverse: Heavy tax-loss harvesting pressure persists into year-end.

Altcoin sector takeaway

DeFi (led by UNI tokenomics shifts) offers rare bright spots; most sectors face liquidity drain and underperformance.

Market metrics and sentiment indicators

- BTC dominance: Grinding toward 60%, signaling defensive rotation. Unlikely to reverse without BTC convincingly breaking the mid-$90,000s.

- Market sentiment: Fear & Greed Index in Extreme Fear territory (23–29 range), reflecting cooled optimism and cycle-peak concerns. Stablecoin flows flat—no urgency on risk.

Key Events to watch this week

Shortened holiday week (New Year's closures); no major data. FOMC minutes (from December meeting) released mid-week could influence early 2026 rate expectations. Watch Jobless claims (Dec 31) for labor signals.

Possible scenarios for the upcoming week

Bearish case

- Loss of $85,000 on volume triggers a faster downside to $75,000–$80,000. Alts accelerate and bleed in thin conditions.

Neutral case (most likely)

- Sideways grind in $85,000–$90,000. Low volume, compressed volatility, gradual alt underperformance. Rewards patience over leverage.

Bullish case

- convincing break and close above $92,000 sparks short covering toward $98,000+. Requires an unexpected catalyst in the offline week—low probability.

Bottom line

With liquidity scarce, protecting capital matters more than chasing marginal setups. Holiday thinness amplifies mistakes; the edge remains limited. Broader setup neutral-bearish lean until January volume returns.

Monitor UNI for continued idiosyncratic strength from fee mechanics. Otherwise, set alerts: $85,000 downside, $92,000 upside. If range holds, minimal cost to sit out and welcome 2026 refreshed.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. TabTrader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.