*Updated November, 25th.

Key takeaways

- The crypto market enters the week in extreme fear, shaped by a broader risk-off environment and a sharp pullback over the past two weeks. Traders are cautious ahead of US Thanksgiving and key economic data, while BTC dominance rises and stablecoin flows increase.

- There’s a noticeable tug between traders betting on an AI bubble unwinding and those leaning into the policy boost from Trump’s “AI Genesis Mission” signing.

- The “Altcoin Season” index is sitting at historic lows. Liquidity has thinned out across nearly every sector, and rising BTC dominance is leaving very little room for altcoins to breathe.

Market overview

The crypto market is sitting firmly in extreme fear, shaped by a broader risk-off mood and a sharp pullback that’s been building for two weeks. Sentiment has just slowly drained.

Global markets are dealing with stretched tech valuations, and that pressure is seeping into crypto. A small bounce early Monday didn’t change much; the tone is still cautious, with most players keeping their exposure tight.

Key drivers of market sentiment

- US Thanksgiving (Nov 27): Liquidity thins out every year around this time, and this week is no exception. When trading dries up, even minor orders can shove prices around. Expect the kind of exaggerated moves that show up when most desks are half-staffed.

- Delayed economic data: The government shutdown has pushed back official reports, especially inflation data. With those gauges missing, the Fed and investors are working with partial visibility heading into the December rate call. No one likes steering without a full dashboard.

- AI narrative clash: There’s a noticeable tug between traders betting on an AI bubble unwinding and those leaning into the policy boost from Trump’s “AI Genesis Mission” signing. That disagreement is turning into volatility, which tends to flush out anyone trading on borrowed conviction, both in tech stocks and across crypto.

Bottom line?

Money is rotating toward safety. Cash positions are growing, and Bitcoin is getting defensive. Altcoins, meanwhile, are taking most of the damage as traders back away from anything that requires patience or extra risk tolerance.

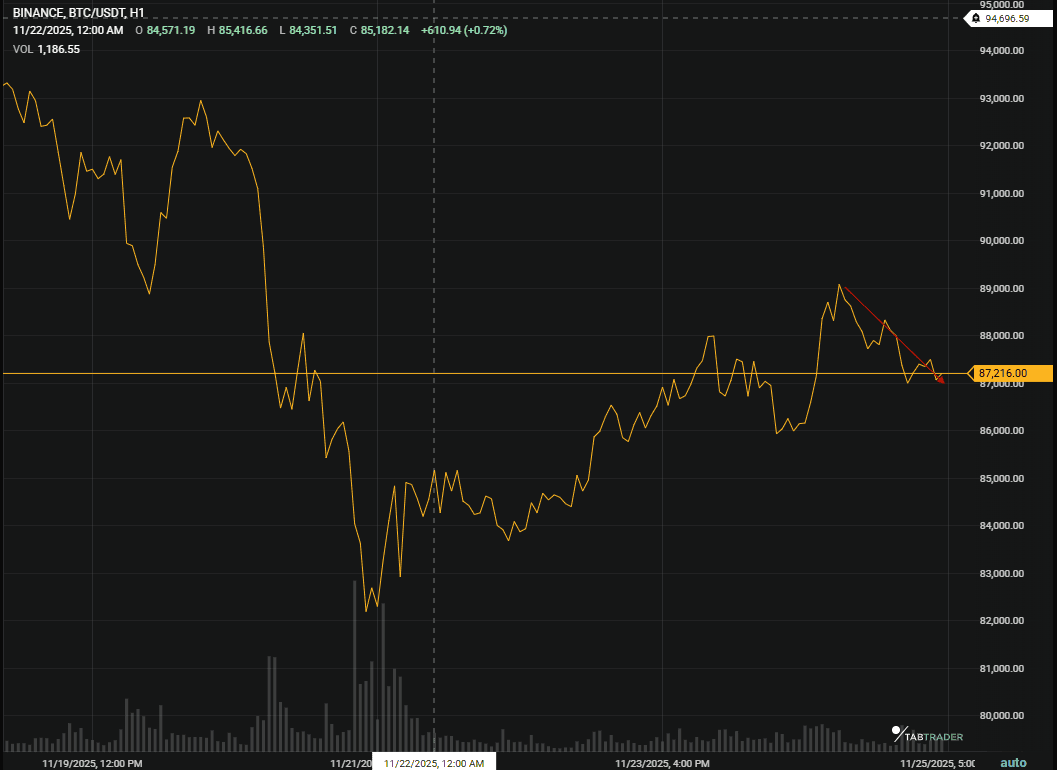

Bitcoin (BTC)

Bitcoin has slipped under the significant psychological markers, first $100k, then $90k, and is now trying to keep its footing in the mid-$80k area. The chart isn’t pretty, but the market is stretched enough that a rebound wouldn’t be surprising.

- Major Support: The key area sits around $85,000–$86,000. Lose that, and the path toward $82,500 opens up quickly. It’s one of those zones traders watch out of the corner of their eye, even if they won’t admit it.

- Major Resistance: Upside pressure runs into the $89,000–$92,000 range. Getting back above $92k would take a lot of the sting out of the recent breakdown and force shorts to rethink their confidence.

BTC is down 6% in the past week.

Key indicators

RSI: The daily Bitcoin RSI is sitting below 30, firmly in oversold territory. These readings usually mark the point where sellers start losing steam. Sometimes it sparks a quick bounce, sometimes it just leads to a few days of sideways drifting, either way, exhaustion is creeping in.

MACD: The MACD is deep in the red. Momentum has stretched far enough that it starts to feel like the market is running on fumes.

Bitcoin directional lean

Neutral to bearish. The downtrend is intact, but shorting here isn’t exactly a comfortable setup with everything this stretched. A quick bounce or some holiday-week stabilization is very much on the table, especially with liquidity thinning out.

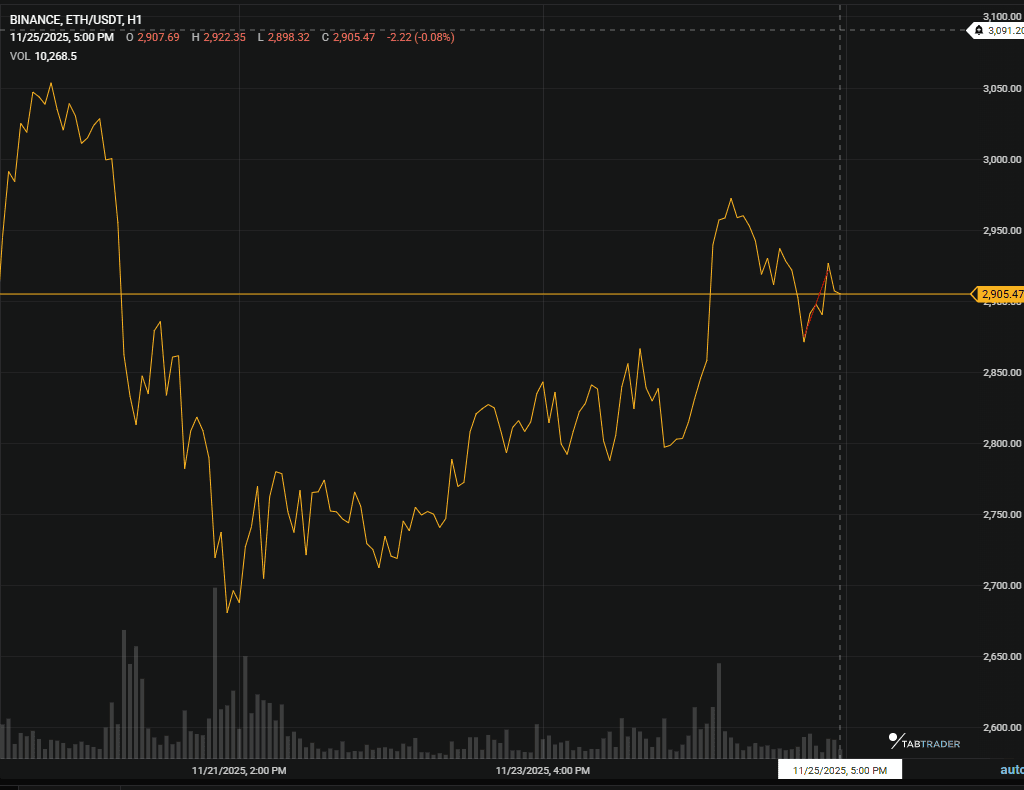

Ethereum (ETH)

Ethereum is still lagging behind Bitcoin and, for now, acting like the high-beta anchor in most portfolios.

The ETH/BTC pair keeps sliding into new lows. That’s a pretty clear sign that the more seasoned capital is still rotating toward BTC for safety and away from anything that feels like extra risk.

ETH is down 7% in the past week.

Strength / Weakness

Structurally, ETH isn’t in great shape. Losing the $3,000 level didn’t help, and it’s been drifting since. Buyers haven’t shown much appetite to establish a firm floor yet.

Key zones

Support: $2,750–$2,800 This is the last meaningful shelf before the chart opens up to a deeper pullback. If this zone gives way, the next strong structural support sits a good distance lower.

Resistance: $3,000–$3,200 What used to be support is now working against the bulls. ETH needs to get back above $3,000 just to slow the slide and convince the market it’s not in freefall mode.

Major Altcoin sector overview

| Sector | Tokens | Trend | Quick Take |

| Layer 1 | SOL, ADA, AVAX | Bearish | Even the stronger names have given back a noticeable chunk of their gains. They’re holding up better than the small caps, but that’s mostly a low bar at this point. Traders aren’t exactly eager to step in front of falling charts. |

| DeFi | UNI, AAVE, MKR | Bearish | TVL continues to shrink as yields lose their appeal relative to the risk. A lot of capital is quietly rotating into stablecoins (USDT/USDC), which tells you how cautious the mood is. People prefer sitting in cash rather than riding out token volatility. |

| Gaming/Metaverse | SAND, AXS, MANA | Very bearish | Retail energy is gone, and gaming tokens rely on hype more than anything. SAND ($0.28) and AXS continue drifting lower despite the AI-integration headlines. |

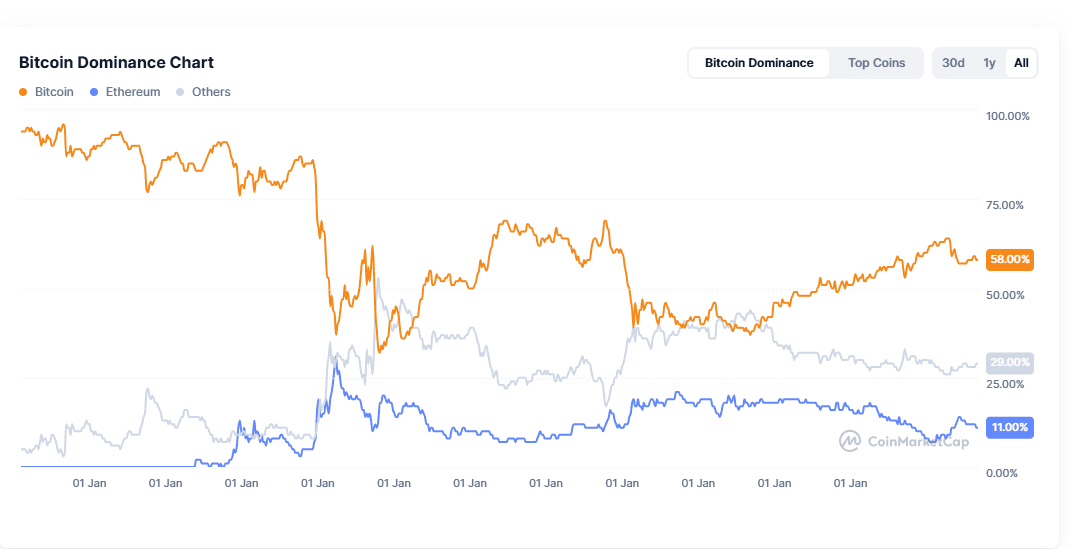

The “Altcoin Season” index is sitting at historic lows. Liquidity has thinned out across nearly every sector, and rising BTC dominance is leaving very little room for altcoins to breathe.

Cash is winning by default. Nothing is meaningfully outperforming in dollar terms, and relative to BTC, Layer 1s are simply the “least bad” option in a neighborhood having a rough week.

Sentiment indicators

Crypto Fear & Greed Index:19 (Extreme Fear) A month ago this was sitting north of 70, so sentiment has fallen off a cliff. Moves this fast usually mark the late stage of a selloff, where most people have already thrown in the towel. The old “be greedy when others are fearful” line fits the moment, though you still want to be selective rather than heroic.

Bitcoin Dominance (BTC.D): 59.2% Dominance keeps grinding higher, which tells you the flight-to-safety mindset hasn’t run its course. As long as this trend holds, expecting a broad altcoin rebound is wishful thinking. The next real test is around the 60% area; that’s where BTC.D has a chance to cool off.

Image source: CMC

Stablecoin flows Money continues shifting from risk assets into USDT, mostly from traders choosing to sit tight and wait for cleaner entries. It’s the classic “park it and observe” behavior you see when confidence is thin and no one wants to force trades.

Key financial events to watch this week

- Monday / Tuesday: Trump’s “AI Genesis Mission” Signing Expect some noise around AI-linked crypto names like FET and RENDER. The move could also ripple into the broader tech mood, depending on how traders interpret the policy angle. Get full brief here.

- Wednesday, Nov 26: PCE Inflation Data (tentative) If it actually gets released, this is the number the Fed pays the most attention to. A hotter print would make a December rate cut basically impossible; a cooler reading could finally give markets something positive to chew on.

- Thursday, Nov 27: US Thanksgiving Markets go quiet. Liquidity thins out. It’s the kind of day where charts drift or pull off quick head-fakes because half the usual participants are away.

- Friday, Nov 28: Black Friday / Early Close Traditionally slow in equities. Crypto, on the other hand, can get pushed around when liquidity drops. Whales know this and sometimes take advantage of the soft order books.

Possible BTC scenarios

Bearish scenario

If BTC cracks below $85,000 with real volume behind it, that’s enough to trigger a fresh round of long liquidations. The obvious destination from there is the $82,500 zone.

Neutral scenario

A quiet, holiday-style range between $86,000–$89,000. Not much volume, not much direction, just the usual Thanksgiving drift while most traders step away.

Bullish scenario

A push back above $92,000 would put the recent breakdown into question. It would act as a swing-failure setup and put pressure on anyone who chased shorts too late. A move like that targets a relief run toward $98,000.

Bottom line

The setup for the week is simple: don’t get cute with fresh shorts down here. Fear is maxed out, indicators are stretched, and holiday liquidity is about to dry up. The ideal short was back at $100k, not in the mid-80s after two weeks of selling.

Let the market settle, watch how it behaves around $85k, and keep cash as your main tool. Surviving choppy weeks like this is more valuable than trying to squeeze out a hero trade.

Want to learn more about technical analysis? Start here:

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.