Crypto Market Weekly Outlook: Crypto Under Pressure as Markets Await CPI (December 15th, 2025)

Key takeaways

- Bitcoin is setting the tone, with the price slipping below its short-term moving averages, keeping near-term downside pressure.

- Ethereum has held up better than Bitcoin on the margin, though that strength is relative rather than absolute.

- The CPI release on Thursday is the inflection point. CPI data will heavily influence rate expectations, and price action around the release is likely to be noisy.

- The market is in a structural holding pattern with a slight bearish bias. Restraint is the dominant strategy, and traders should avoid forcing trades until the macro picture clears.

Market overview

The broader market has shifted into a clear holding pattern. Early December delivered enough volatility to make traders cautious, and that caution is now beginning to show up across both equities and crypto. Price action has cooled as participants wait for clarity from the macro calendar rather than forcing trades.

Two events sit at the center of attention this week. US CPI data on December 18 will shape expectations for monetary policy into the year-end. On Monday, the SEC’s crypto privacy roundtable holds a key meeting on crypto privacy, particularly for privacy-focused assets.

Outside the US, central bank decisions from the ECB and the Bank of Japan could move currency markets. Any sharp reaction in the dollar would almost certainly spill into Bitcoin.

Overall risk appetite remains slightly defensive. Capital is not rushing in, leverage is being used sparingly, and liquidity is thinning as traders step back. Until inflation data provides a clearer signal on the Fed’s next move, most market participants appear content to wait rather than commit. The result is muted price action, failed upside attempts, and a slow, uneven drift lower rather than aggressive selling.

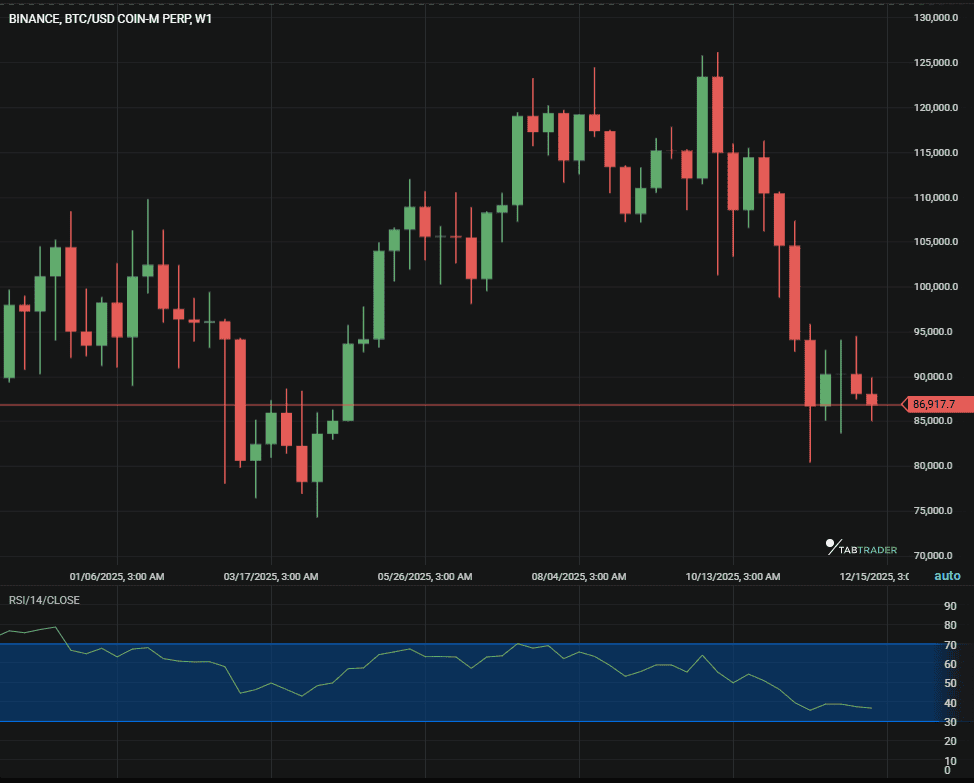

Bitcoin (BTC) analysis

Bitcoin continues to quietly set the tone for the broader market. Price has slipped below short-term moving averages, keeping pressure on the downside, yet it is still defending a key psychological zone. This combination suggests a market lacking conviction, with control shifting back and forth rather than a decisive trend emerging.

BTC/USDT

Key levels to watch

The $89,000–$90,000 zone is doing the heavy lifting right now. The zone needs to hold to prevent a deeper flush. If that gives way, the next logical downside target sits near $85,000, where buyers previously stepped in with more conviction.

On the upside, $92,500 has marked the top of recent tries for breaks higher and remains the first level of any momentum that needs to clear. A bit more importantly, $96,000 is the mark that would start to repair the broader structure and signal a more meaningful trend shift.

Technical indicators

Momentum indicators are neutral. Overbought pressure has been removed as the RSI cooled into the mid-40s, leaving room for expansion once a catalyst is delivered. Moving averages lean against price, with the 20-day EMA acting as overhead resistance rather than support.

The near-term bias remains slightly bearish, but without urgency. Expect choppy, range-bound trading unless a clear catalyst forces resolution.

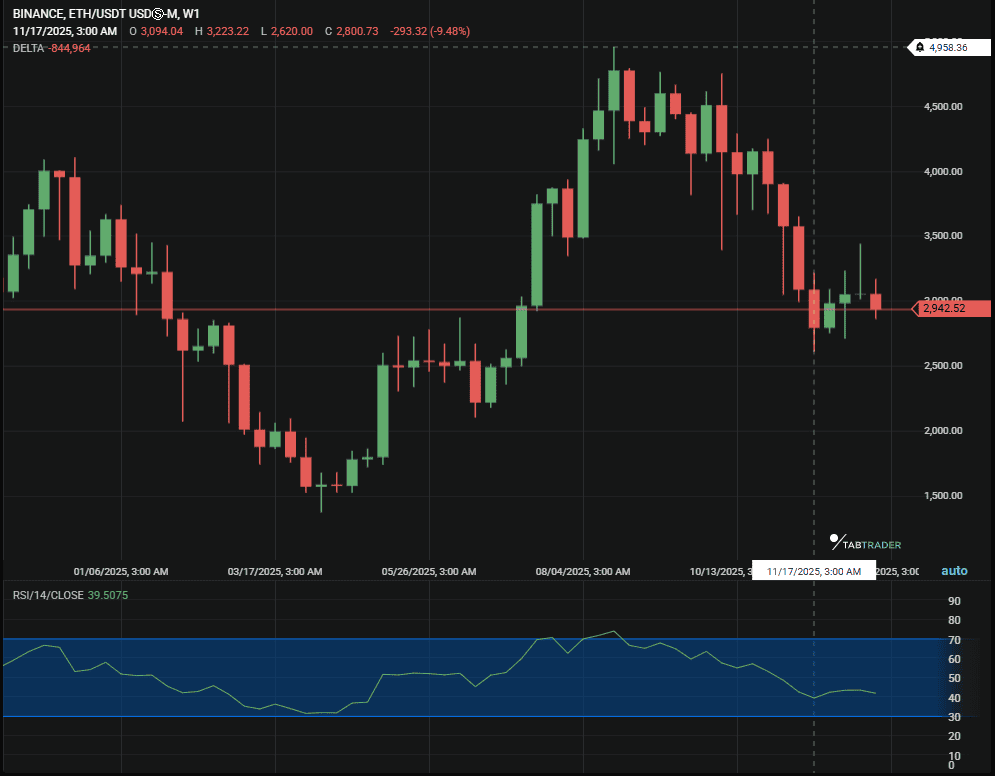

Ethereum (ETH) snapshot

Ethereum has held up better than Bitcoin on the margin, though that strength is relative rather than absolute. Price continues to drift back and forth between roughly $3,100 and $3,200, reflecting the same indecision seen across the broader market.

ETH/USDT

Against Bitcoin, the ETH/BTC pair has stabilized and is showing small signs of basing. That is constructive, but volume remains thin, which limits the odds of a sustained move. For now, this looks more like early footing than a breakout attempt.

The $3,050–$3,100 zone has become the line in the sand. Buyers have consistently stepped in here, and each test has been met with a quick response. As long as this area holds, downside risk appears contained.

On the upside, $3,350 remains the level that matters. Price needs a clean, convincing push through that area before any shift in momentum can be taken seriously. Until then, ETH is grinding, not trending.

Major Altcoin sector overview

Liquidity remains scattered, but it is not evenly weak. Capital is selective, and certain themes are absorbing attention even as the broader altcoin market struggles to gain traction.

Layer 1 (L1)

Most Layer 1s continue to shadow Bitcoin’s movements, with little independent momentum. Solana still attracts buy-on-dip interest, particularly from larger players who appear comfortable accumulating on weakness. Cardano, by contrast, is stuck in uneven consolidation, with no clear signal that either side is pressing an advantage. Overall, this group feels stable but uninspired.

DeFi

Core DeFi protocols are quietly holding their ground. In a market short on conviction, these assets are functioning as a lower-volatility corner of the altcoin space. Total Value Locked has remained steady, which suggests capital is staying parked rather than exiting. Activity is muted, but the lack of meaningful outflows remains a matter of concern in this environment.

Gaming

This is where relative strength is showing up. The gaming sector is pushing higher into mid-December, helped along by year-end releases and token-related catalysts. Several names have begun to trade on their own fundamentals rather than reacting to every Bitcoin pullback. That decoupling stands out in a market otherwise defined by hesitation.

Sector takeaway

Gaming currently offers the clearest momentum for traders willing to take on higher risk. Layer 1s remain better suited for slow accumulation rather than active positioning, while DeFi sits in between—quiet, stable, and waiting for broader conditions to improve.

Market metrics and sentiment

- BTC dominance (58.5%): Bitcoin dominance has leveled off after weeks of movement in one direction. This kind of pause usually shows up when the market is weighing its next move. Either Bitcoin starts to pull capital back toward itself, or money begins to leak into altcoins. For now, neither side is winning, which fits with the broader theme of hesitation.

- Fear & greed index (15/100, extreme fear): Sentiment has cooled meaningfully from last month’s excess. The shift away from extreme optimism toward caution tends to reduce forced buying and emotional chasing. Historically, conditions like this have favored patient accumulation rather than aggressive positioning, especially compared with periods when sentiment is stretched to the upside.

Key events to watch this week

- Monday, December 15, SEC crypto privacy roundtable Regulatory commentary around privacy remains a lingering risk. Any unexpected tone shift could ripple through privacy-focused tokens and, by extension, parts of DeFi.

- Thursday, December 18, US CPI inflation data This is the main volatility catalyst for the week. CPI will heavily influence rate expectations, and price action around the release is likely to be noisy, with sharp moves in both directions before a clearer trend emerges.

- Friday, December 19, Bank of Japan interest rate decision While not directly tied to crypto, BOJ policy decisions often spill into currency markets and global liquidity conditions. A surprise here could indirectly feed into risk assets, including Bitcoin.

Possible scenarios for the upcoming week

Bearish: A daily close below $89,000 would signal that support has finally given way. In that case, stops are likely to cluster just beneath the level, increasing the odds of a fast move toward the mid-$80,000s, with $85,000 as the most obvious magnet. In this environment, the priority shifts to capital protection and patience rather than early bottom-fishing.

Neutral: The more probable outcome in the absence of a catalyst is continued back-and-forth between roughly $90,000 and $92,000. This keeps Bitcoin busy while altcoins slowly lose ground on relative terms. Conditions like this tend to reward either disciplined range trading or doing very little at all.

Bullish: A sustained push back above $92,500, supported by clear volume expansion, would improve the technical picture. A move like that, particularly if it follows CPI, would put $96,000 back into play as the next area of interest. If the reclaim holds, pullbacks toward former resistance could offer more controlled long setups rather than chasing strength.

Bottom line

This is a week where restraint matters more than activity. Price is stuck between clearly defined levels, with support near $88,000 and resistance around $92,500, and there is little incentive to force trades inside that range. Preserving capital takes precedence while the market waits for direction.

The CPI release on Thursday is the inflection point. Trying to position ahead of it adds unnecessary risk. A better approach is to let the data hit, allow the initial volatility to pass, and then respond to what the market actually does.

As long as $88,000–$89,000 holds on a closing basis, the broader structure has not fully broken. If it fails, the conversation changes quickly.

For now, patience remains the most valuable position.

Trade Smarter. Scan these levels live in TabTrader now available at 50% off.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.