Key takeaway:

- Unlike the clean breakout scenario initially anticipated, the market has stalled following the Fed's Wednesday 25 bps rate cut. While the macro backdrop is shifting to accommodating, price action is currently trapped below key resistance. The job for traders right now is patience and defense, not aggressive trend following.

Commentary

1. The Macro driver: Federal reserve rate cut

The end of Quantitative tightening set the stage, but the real inflection came on Wednesday when the Fed delivered a quarter-point cut. It arrived in line with market expectations, though the summary of economic projections signaled only one additional cut in 2026 amid persistent inflation concerns, tempering the initial enthusiasm.

- Fed cut impact: The cut essentially told the market that liquidity is no longer the enemy. With policy drifting toward an easier stance, the dollar softening, and yields edging lower, crypto suddenly looked a lot more appealing relative to bonds and cash. Traders wasted no time positioning around that shift.

- Crypto market pulse after rate cut: The reaction was quick but short-lived. Volatility picked up the moment the statement hit, sparking a brief rally that started the week prior. By Wednesday afternoon, most major assets had tested resistance bands they had been stuck under for nearly two weeks, but failed to hold gains.

The rally reflected strong, confident buying from players who had been waiting for the Fed to ease, but rejection at prior highs quickly cooled the momentum, turning it into a classic bull trap.

2. Price movements of key assets

Momentum carried over from last week, but follow-through lacked conviction. Bitcoin tested the level it had been wrestling with for nearly two weeks, but failed to hold or close above it. The broader market moved in sympathy with limited upside.

3. Bitcoin (BTC)

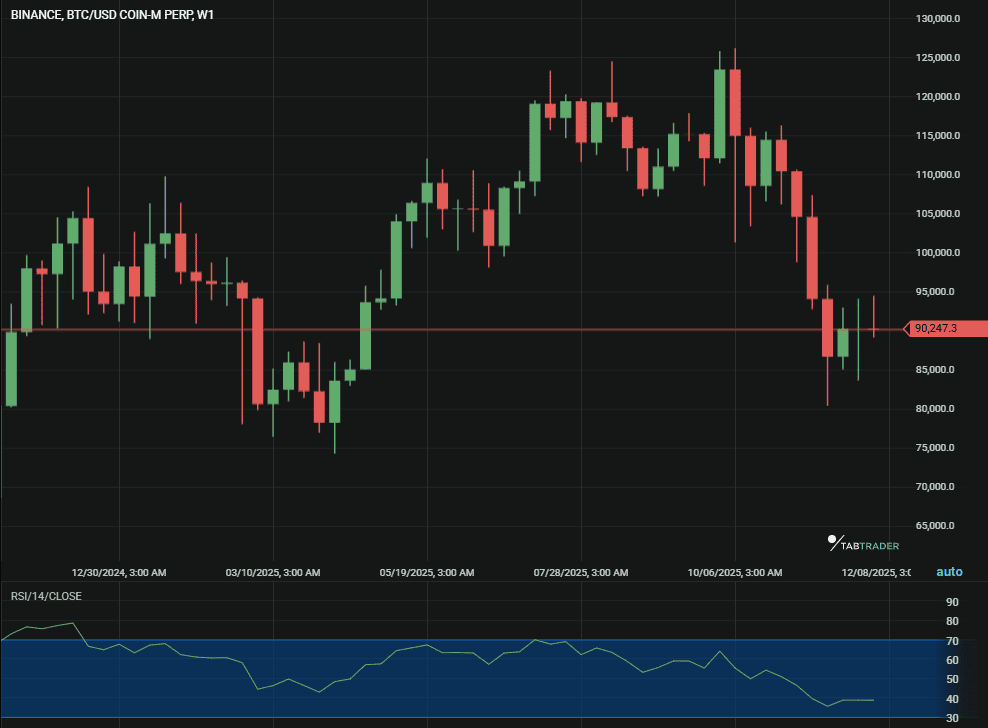

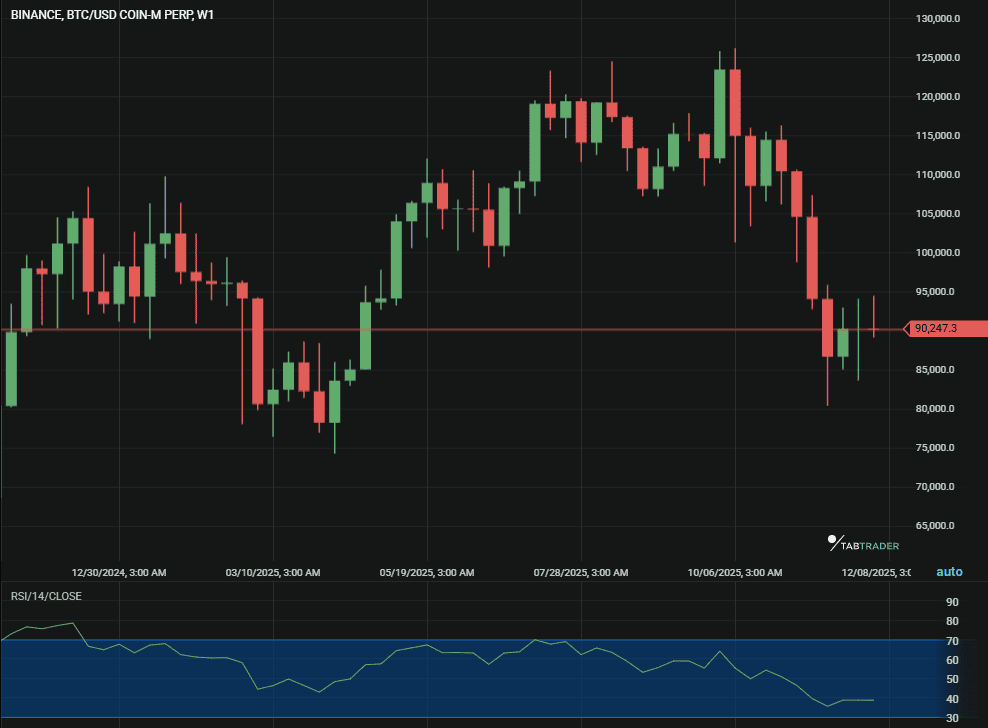

Bitcoin attempted to challenge the $92,000–$93,000 band that has been stonewalling price action. However, the buying pressure failed to sustain momentum once the Fed news settled. Currently, Bitcoin is trading near $90,500, distinctly below the critical ceiling.

Get the latest price on the Tabtrader live chart.

- Breakout confirmed? No. BTC tapped resistance multiple times but never closed above it with conviction. Post-cut buying pushed the price briefly above $93k, only to meet heavy supply and reject lower.

- Support: The $90,000 area is now the level to watch. As long as Bitcoin stays above that, the short-term trend keeps its momentum. If price starts slipping back toward $88,000, that would be an early sign that the rally is losing steam and may need a deeper reset.

4. Ethereum (ETH): Altcoin rotation accelerates

Ethereum kept outperforming Bitcoin this week, which lines up cleanly with the shift we saw in the ETH/BTC ratio earlier. The rotation into higher-beta majors is happening in real time.

- ETH/BTC ratio: The ratio broke out decisively, showing that capital is starting to drift away from BTC and into assets with more torque. Moves like this often mark the early stages of a broader altcoin cycle, and this one has the feel of a rotation that still has room to run.

- Technical view: ETH pushed through the $3,300 level without much pushback and is now settling in around $3,250. With that barrier out of the way, the chart opens up toward the next major reference point near $3,800. A level that capped price action for several months earlier this year. If momentum holds, that’s the logical next stop.

ETH/USD

5. Market sentiment

The market sentiment saw a noticeable lift, though caution still prevails, which can be a healthy sign for a sustained rally.

<i>Image source: Alternative</i>

Crypto fear & greed index:

- December 8: 20 (Extreme fear)

- December 12 : 29 (Fear)

The index rose 9 points from Extreme Fear (20) to Fear (29). While a significant improvement, the market has not yet entered "Neutral" or "Greed" territory, suggesting that the rally is still viewed with skepticism by the average trader, which generally avoids an immediate, unsustainable peak driven by FOMO.

Bottom line: Momentum takes over?

The macro backdrop has flipped in favor of risk assets, and the market wasted no time leaning into it. At this stage, the job for intermediate traders is less about guessing the next headline and more about managing a trend that’s already in motion.

As price consolidates, it pays to tighten stops and stay disciplined with position sizing.The ability to hold above $90,000 support will tell us how durable this structure is. If buyers defend those levels, the structure stays intact.

Keep an eye on how BTC behaves around the $92,000 area. A weekly close and hold above $93,000 is still required before any real breakout can be claimed.

Trade faster. Scan these levels live in TabTrader now available at 50% off.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.