Crypto Market Weekly Outlook: Cautious Risk and Consolidation in Crypto, January 13th, 2026

Key takeaways

- Crypto has been riding a wave of optimism that began in traditional markets.

- Bitcoin is slightly down but still in a holding pattern, boxed in between clear institutional support below and steady profit-taking above.

- In the Altcoin sector, capital flow across alts has turned defensive.

- Opportunities exist near well-defined support, particularly BTC around the $89k area or relative-strength names like SOL.

Crypto market overview

This past week, crypto has been riding a wave of optimism which started in the traditional markets and is starting the week on a solid footing.

This is most apparent in the United States of America, equities have pushed to fresh highs, with both the S&P 500 and Dow Jones benefiting from a strong tone going into earnings season.

Additionally, early reports from all the major banks, including JPMorgan and Bank of America, have helped set a constructive backdrop, reinforced by economic data that continues to show little sign of immediate stress as of January, 2026.

Crypto has not followed that move. Bitcoin has had a small decrease in value, however, showing none of the urgency seen in equities. This kind of split is not unusual.

This is most likely because crypto markets often lag during equity-led rallies and tend to move later, once macro conditions either confirm or reject the risk-on narrative. For now, price action suggests hesitation rather than weakness.

With all this in mind, the focal point for the week is the US CPI on January 13. Inflation data will likely decide whether this equity momentum spills over into crypto.

If we get a hotter-than-expected report, it would favor a stronger dollar and keep pressure on Bitcoin. A softer reading, in contrast, removes that headwind and gives BTC room to challenge the $93k level, assuming risk appetite holds elsewhere.

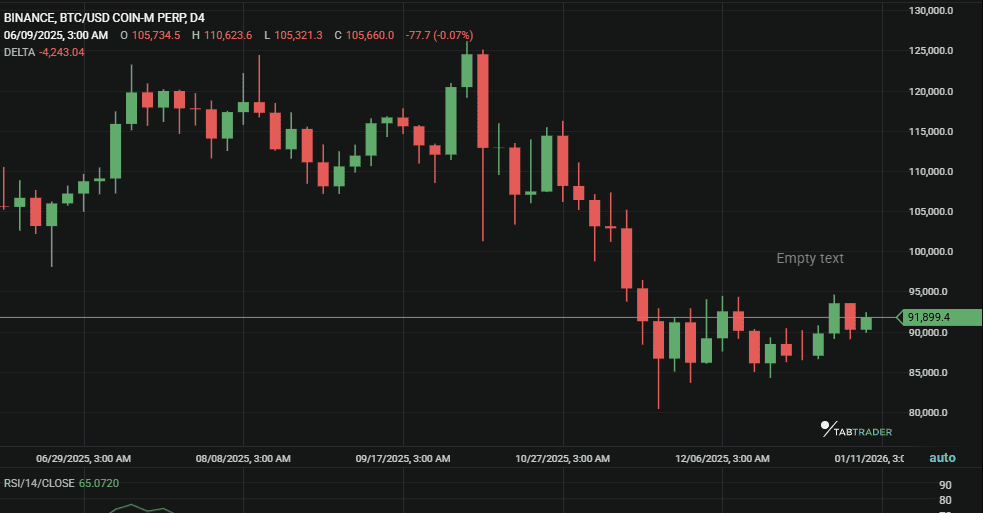

Bitcoin (BTC) analysis

Compared to last week, Bitcoin is slightly down but still in a holding pattern, boxed in between clear institutional support below and steady profit-taking above.

Price is behaving well technically, which makes this a relatively clean range to work with, but also explains the lack of follow-through in either direction.

BTC/USDT

Key levels

Here are the key levels for Bitcoin for the week of January 12th, 2026:

- Support: $88,000–$89,000, This narrow area remains the key level to watch. As long as buyers continue to defend it, the broader uptrend will remain intact. On the opposite side of things, a clean loss here would change the tone quickly.

- Resistance: $93,500–$95,000, This resistance zone is where momentum has repeatedly stalled. A decisive break and hold above this zone would shift attention toward the $98k–$100k area, but that move likely needs a macro push rather than pure technicals.

Technical indicators

- RSI: RSI is still near 50, which lines up with what price is showing. The market is undecided, and neither side has control right now.

- Moving averages: Bitcoin remains above the 50-day SMA. That keeps the medium-term structure constructive, even if the short-term action is dull.

- Bias: Neutral to bullish. The higher-probability approach remains patience. Favor longs near support rather than chasing momentum in no-man’s land. Until the range breaks, discipline matters more than conviction.

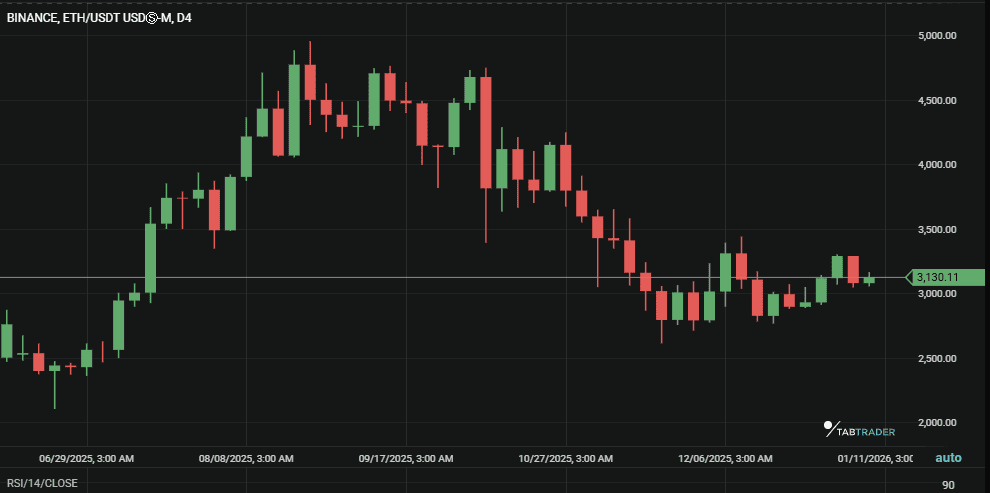

Ethereum (ETH) snapshot

This week, Ethereum continues to trail Bitcoin mirroring activity we saw last week. It has yet to show any meaningful relative strength.

Accordingly, Ethereum's price action remains sluggish and unmoving, even as on-chain activity stays elevated. In simple terms, this week, the ETH network is active, but the market is not in a hurry to reprice that activity any time soon.

ETH/USD

ETH is currently behaving like a slightly slower version of Bitcoin. It tends to give up more ground during pullbacks and struggles to keep pace during rallies. This week, that dynamic has been consistent and argues for caution rather than anticipation.

Key levels

- Support: $3,050–$3,100. This zone has held multiple tests and carries both structural and psychological weight. A clean break would likely invite faster downside.

- Resistance: $3,300. This is the level that matters. Until ETH can reclaim and hold above it, momentum remains capped.

Ethereum future outlook

Given the above data, it is our opinion that leverage is doing more harm than good here. Until price establishes acceptance above $3,300, ETH longs are better kept light and tactical rather than aggressive.

Major Altcoin sector overview

In the Altcoin sector, capital flow across alts has turned defensive. This is because traders are concentrating exposure in assets with established liquidity and usage, while sidelining more speculative sectors until major assets like Bitcoin show clearer intent.

Layer 1s (SOL, BNB, AVAX)

Layer 1 group of altcoins remain the relative outperformers. Solana, in particular, continues to hold up well and has benefited from renewed attention around the new Alpenglow upgrade. More importantly, historical trading data shows that Layer 1s tend to be first in line when Bitcoin resumes an upward move, which keeps this sector on the radar despite broader consolidation.

DeFi (ENA, AAVE, UNI)

DeFi Price action is uneven this past week. Some tokens are stabilizing, while others are drifting, and conviction remains selective. Ethena is worth monitoring after recent unlocks; if supply absorption holds and price stabilizes, it could set up a cleaner entry. Until then, this sector requires discrimination rather than blanket exposure.

Gaming / Metaverse (IMX, SAND)

This sector remains the weakest pocket of the market. These assets carry high beta and have been slowly leaking value against Bitcoin. There is no urgency to engage here. Without a decisive BTC breakout and a return of broad risk appetite, this sector is better left alone.

Altcoin sector takeaway For now, long exposure makes the most sense in higher-quality Layer 1s, with Solana leading the group. Gaming and Metaverse tokens can wait. Chasing laggards before risk appetite returns has not been rewarded.

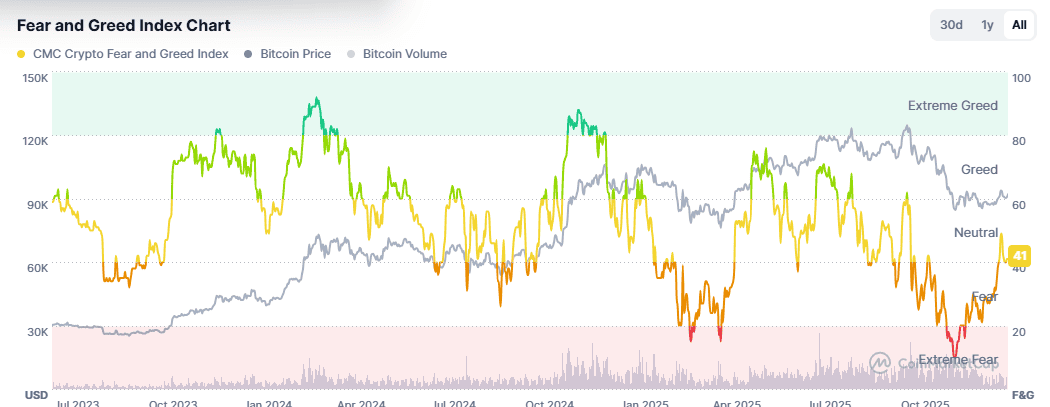

Market metrics

Fear & Greed Index: 41 ( Neutral)

Image source CMC.

This week, sentiment remains cautious, even with Bitcoin holding near the $90k area. That gap between price and mood matters. The market is not crowded on the long side, and positioning appears relatively clean. If macro data comes in supportive, there is room for price to move without immediately running into euphoric behavior.

BTC Dominance: 58–59%

BTC dominance is rising as capital continues to migrate out of altcoins and into Bitcoin. This reflects internal risk-off behavior rather than outright panic. In practical terms, Bitcoin is being treated as the defensive asset within crypto. Fading BTC in favor of broad alt exposure has been a losing trade in this environment and remains poorly timed.

Key events to watch this week

Tuesday, Jan 13: US CPI (Inflation Data)

This is the main event. CPI will likely set the tone not just for crypto, but for risk assets overall. Expect elevated volatility around the release.

Wednesday, Jan 14: US Retail Sales

Retail sales provide a read on consumer resilience. A strong print supports the soft-landing narrative and generally aligns with a constructive backdrop for risk assets, including crypto.

All week:

US Bank Earnings (JPMorgan, Citi, Wells Fargo) Earnings strength in the banking sector has already helped equities push higher. Continued upside here could keep equity sentiment firm, which has historically provided a supportive tailwind for Bitcoin.

Possible scenarios for the next seven days

Bearish case

The downside risk comes from macro disappointment or a clear technical failure. A hotter-than-expected CPI print, or sustained inability to hold the $89k area, would put pressure on the range. A decisive 4H close below $88k would signal acceptance lower. In that case, price would likely move quickly toward the $84k–$85k zone, where liquidity has been building.

Neutral case

This remains the base case. If incoming data sends mixed signals, Bitcoin is likely to continue oscillating between roughly $89k and $93k. There is little edge in forcing trades inside that band. The cleaner opportunities sit near the extremes, not in the middle.

Bullish case

The upside scenario requires confirmation from macro. Softer CPI data combined with continued strength in US equities would improve risk appetite. A strong, high-volume reclaim of $93.5k would shift structure and open the path toward the high $90k region. From there, upside acceleration becomes more likely as short positioning is forced to unwind.

Bottom line

The takeaway from the above data is that this is a waiting week. Price structure remains constructive, but momentum has stalled, and the next meaningful move likely depends on Tuesday’s CPI release.

From historical data, experience traders know that trying to front-run that outcome adds more risk than edge. The cleaner approach is to let price react first and work from there.

Here’s how traders should approach trades this week:

- For more active traders: Opportunities exist near well-defined support, particularly BTC around the $89k area or relative-strength names like SOL. Risk needs to stay tight. These are tactical trades, not conviction bets.

- For more conservative traders: Patience remains the trade. Holding cash and waiting for confirmation above $93,500 on BTC or $3,300 on ETH avoids unnecessary exposure while the market resolves its next direction. Discipline matters more than activity in this environment. The market will offer clearer entries once the data is out and volatility settles.

Trade Smarter. Scan these levels live in TabTrader.

Important Note: TabTrader does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Tab Trader may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such. TabTrader does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make.